40 price of coupon bond

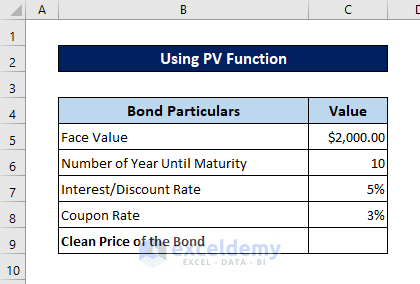

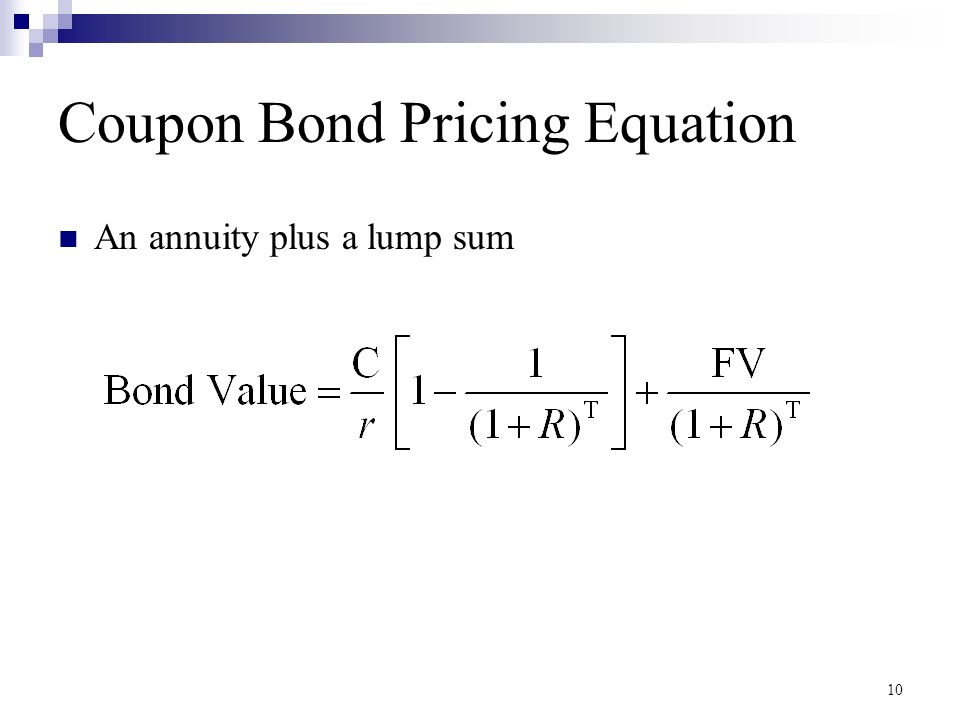

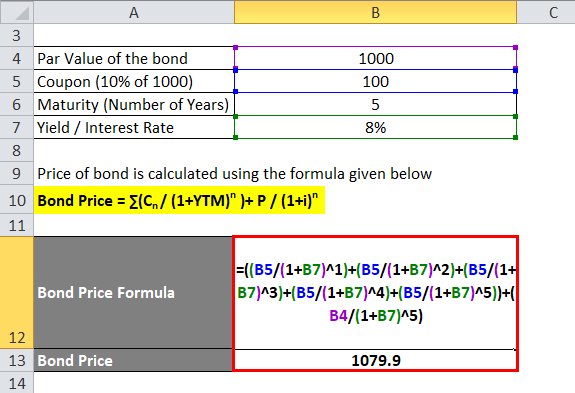

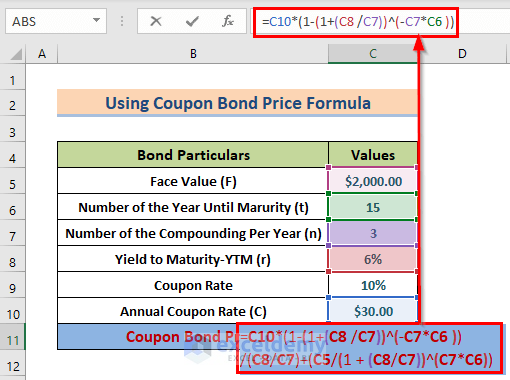

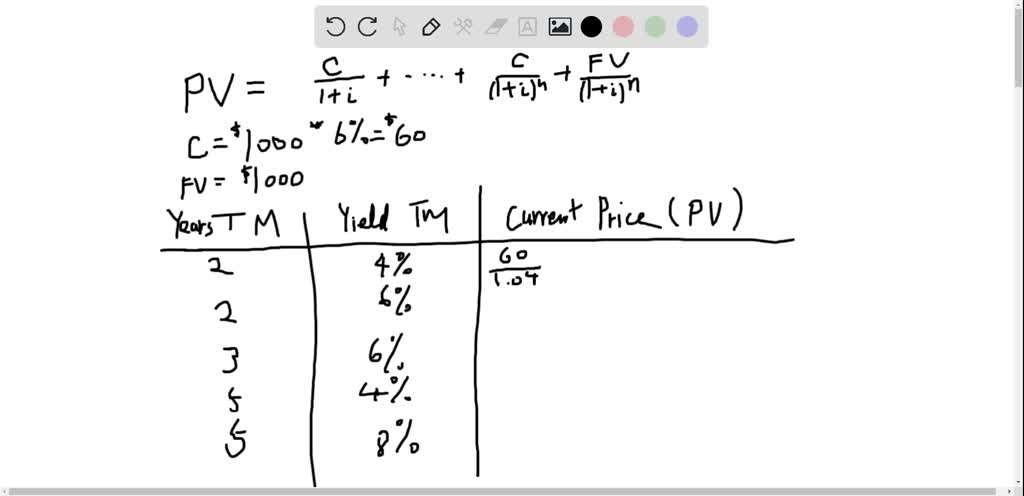

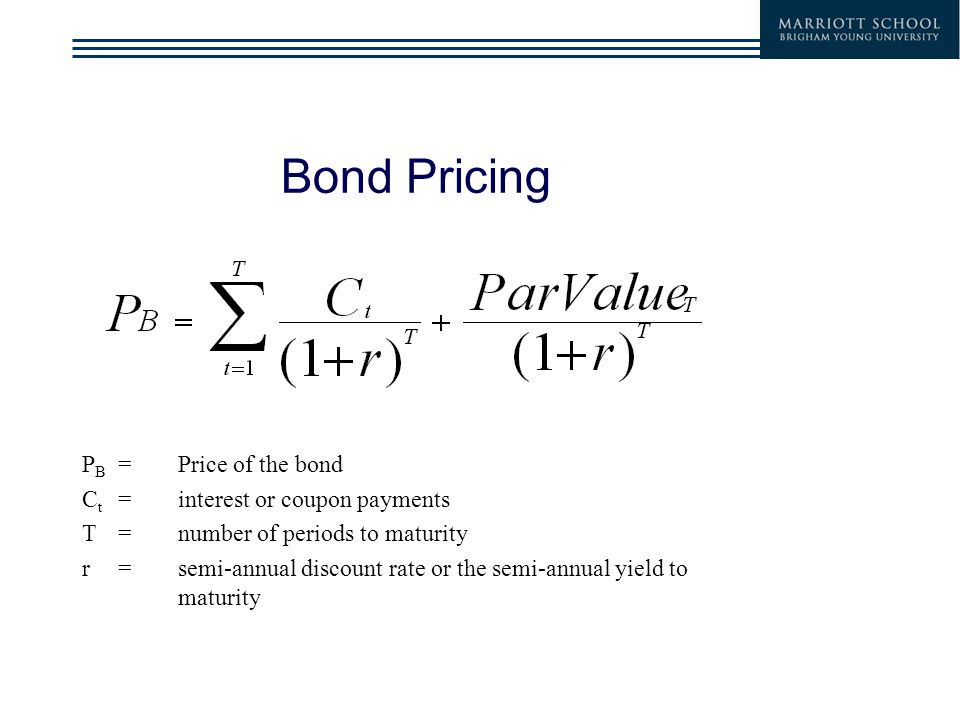

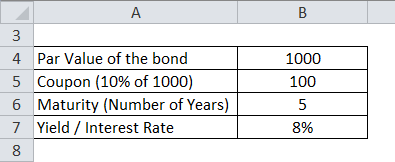

Bond Pricing - Formula, How to Calculate a Bond's Price A coupon is stated as a nominal percentage of the par value (principal amount) of the bond. Each coupon is redeemable per period for that percentage. For example, a 10% coupon on a $1000 par bond is redeemable each period. A bond may also come with no coupon. In this case, the bond is known as a zero-coupon bond. Coupon Bond Formula | How to Calculate the Price of Coupon Bond? = $838.79. Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate

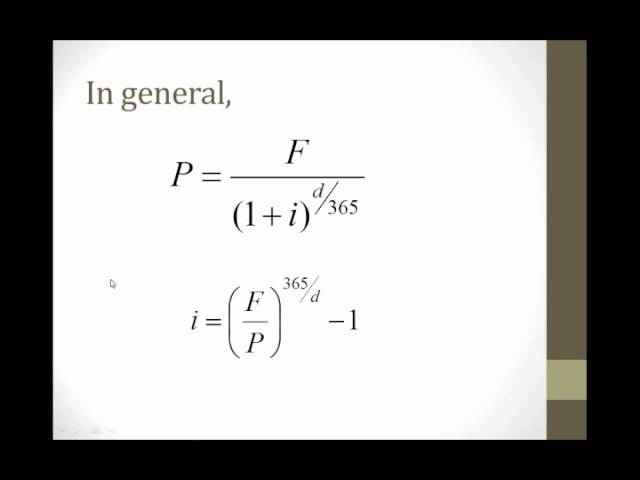

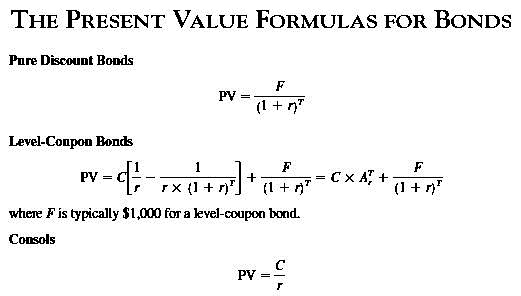

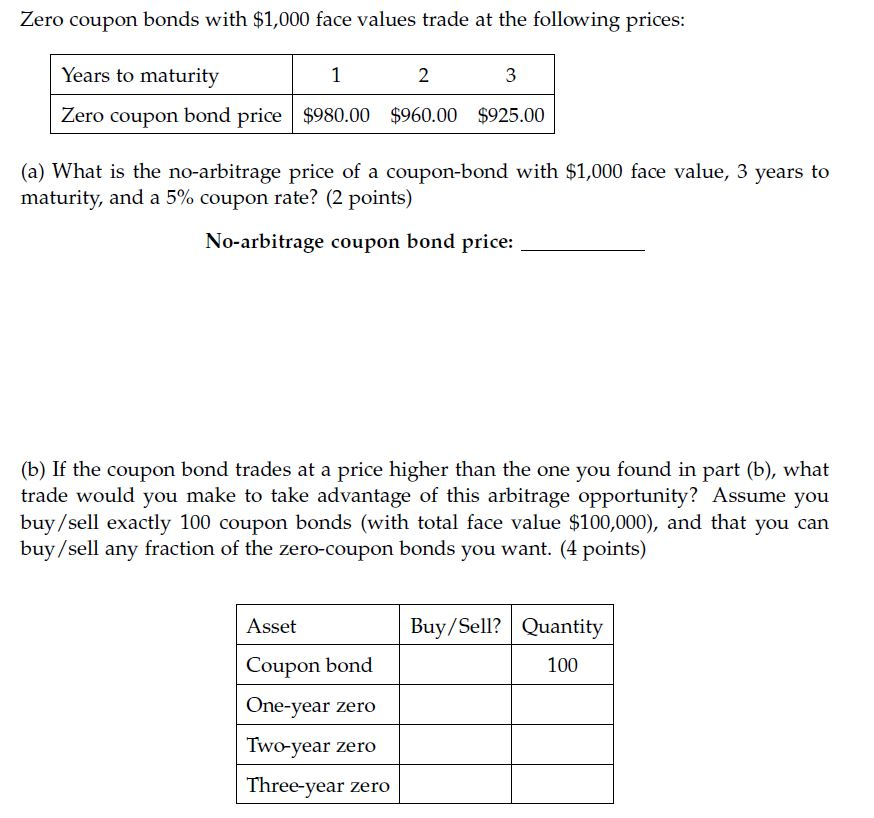

How to Calculate a Zero Coupon Bond Price | Double Entry ... The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) The present value of the cash flow from the bond is 816, this is what the investor should be prepared to pay ...

Price of coupon bond

Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA Coupon Bond = $951.68. Therefore, the price of the CB raised by ZXC Inc. will be $951.68. Coupon Bond Price. The price of a CB (or any other bond)represents its market value or how much the investors are willing to pay in the open market. Please understand that a bond is sold at its par value at the time of issuance, and later the value changes ... Bond Price Calculator – Present Value of Future Cashflows - DQYDJ Days Since Last Payout - Enter the number of days it has been since the bond last issued a coupon payment into this field of the bond pricing calculator. Coupon Payout Frequency - How often the bond makes a coupon payment, per year. If it only pays out at maturity try the zero coupon bond calculator, although the tool can compute the market ... Understanding Bond Prices and Yields - Investopedia A bond's yield is the discount rate that can be used to make the present value of all of the bond's cash flows equal to its price. In other words, a bond's price is the sum of the present value of ...

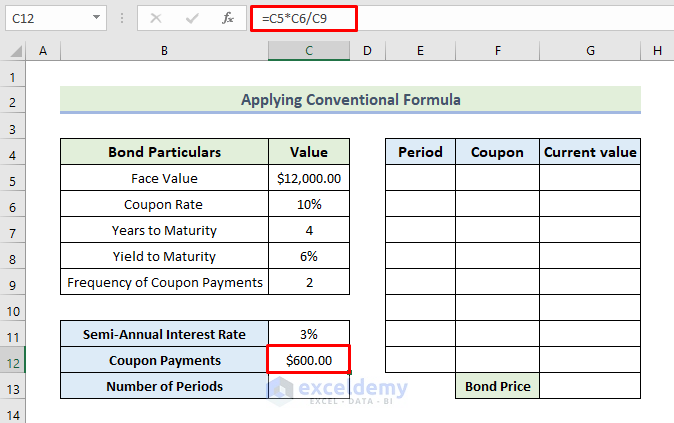

Price of coupon bond. Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep Zero-Coupon Bond Price Formula. To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods. How to Calculate Bond Price in Excel (4 Simple Ways) Method 3: Calculating Dirty Bond Price . Normally the Coupon Bond prices are referred to as Clean Bond prices.If the Accrued Interest is added to it, it's become a Dirty Bond Price.So, the formula becomes. Dirty Bond Price = Clean Bond Price (Coupon Bond Price Annual/Semi-Annual) + Accrued Interest How to calculate bond price in Excel? - ExtendOffice Let’s say there is a annul coupon bond, by which bondholders can get a coupon every year as below screenshot shown. You can calculate the price of this annual coupon bond as follows: Select the cell you will place the calculated result at, type the formula =PV(B11,B12,(B10*B13),B10), and press the Enter key. See screenshot: Bond Price Calculator | Formula | Chart It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity.

Home | Bond Oct 27, 2022 · What makes a good “locally led” funder? Stories from your partners. Bond, in partnership with Recrear and Local Trust, has launched a series of stories to capture how relationships with NGOs and funders are experienced by local partners, as well as which funding models they believe to be supportive of community-led development. Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =. Coupon Bond - Investopedia Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ... Dirty Price - Overview, How To Calculate, Example | Wall Street Oasis Bonds that offer no coupon bonds are known as zero-coupon bonds. The most prominent zero-coupon bonds are US savings bonds and US treasury bills. Bonds are sometimes called bills whenever the maturity of the bonds is less than one year. The coupon rate is the size of coupons received annually divided by the face value of the bond.

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond = $25 * [1 - (1 + 4.5%/2)-16] + [$1000 / (1 + 4.5%/2) 16; Coupon Bond = $1,033; Therefore, the current market price of each coupon bond is $1,033, which means it is currently traded at a premium (current market price higher than par value). Explanation. The formula for coupon bond can be derived by using the following steps: Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Coupon Bond - Guide, Examples, How Coupon Bonds Work Despite the bond's relatively simple design, its pricing remains a crucial issue. If there is a high probability of default, investors may require a higher rate of return on the bond. Similar to the pricing of other types of bonds, the price of a coupon bond is determined by the present value formula. The formula is: Where: c = Coupon rate

What Is a Zero-Coupon Bond? - Investopedia Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

National Bank For Agriculture And Rural Development - Bond Price, Yield ... A bond that pays a fixed coupon will see its price vary inversely with interest rates. This is because bond prices are intrinsically linked to the interest rate environment in which they trade for example - receiving a fixed interest rate, of say 8% is not very attractive if prevailing interest rates are 9% and become even less desirable if ...

Regarding the prices of a Treasury coupon bond, which | Chegg.com Transcribed image text: Regarding the prices of a Treasury coupon bond, which of the following are TRUE? Check all that apply: Supply and demand dexarmines the market price (of a Treasury coupon bond) Supply and demand determines the fair price (of a Treasury coupon bond) Treasury spot rates should be used to find the market price (of a Treasury coupon bond) YTM should be used to find the ...

Bond valuation - Wikipedia Bond valuation is the determination of the fair price of a bond.As with any security or capital investment, the theoretical fair value of a bond is the present value of the stream of cash flows it is expected to generate. Hence, the value of a bond is obtained by discounting the bond's expected cash flows to the present using an appropriate discount rate.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing How the Coupon Rate Affects the Price of a Bond. All types of bonds pay interest to the bondholder. The amount of interest is known as the coupon rate. Unlike other financial products, the dollar amount (and not the percentage) is fixed over time. For example, a bond with a face value of $1,000 and a 2% coupon rate pays $20 to the bondholder ...

Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity.

Answered: What is the price of a bond with a… | bartleby What is the price of a bond with a coupon rate of 5.20% and semi-annual payments, if the yield-to-maturity is 10.20% and the bond matures in 20 years? Assume a par value of $1,000. Question

Bond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · For instance, a bond with a $1,000 face value and a 5% coupon rate is going to pay $50 in interest, even if the bond price climbs to $2,000, or conversely drops to $500. But if a bond's coupon ...

Coupon Rate Definition The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity ...

Understanding Bond Prices and Yields - Investopedia A bond's yield is the discount rate that can be used to make the present value of all of the bond's cash flows equal to its price. In other words, a bond's price is the sum of the present value of ...

Bond Price Calculator – Present Value of Future Cashflows - DQYDJ Days Since Last Payout - Enter the number of days it has been since the bond last issued a coupon payment into this field of the bond pricing calculator. Coupon Payout Frequency - How often the bond makes a coupon payment, per year. If it only pays out at maturity try the zero coupon bond calculator, although the tool can compute the market ...

Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA Coupon Bond = $951.68. Therefore, the price of the CB raised by ZXC Inc. will be $951.68. Coupon Bond Price. The price of a CB (or any other bond)represents its market value or how much the investors are willing to pay in the open market. Please understand that a bond is sold at its par value at the time of issuance, and later the value changes ...

Post a Comment for "40 price of coupon bond"