40 yield to maturity of a coupon bond formula

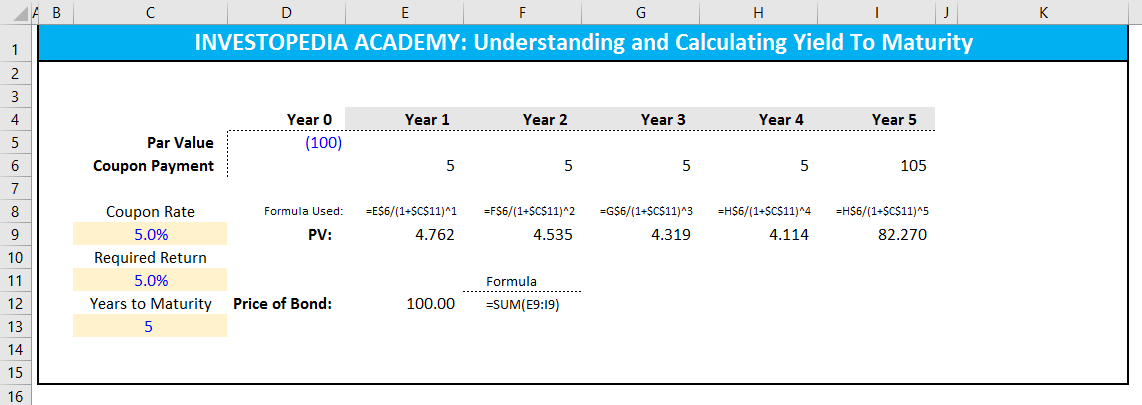

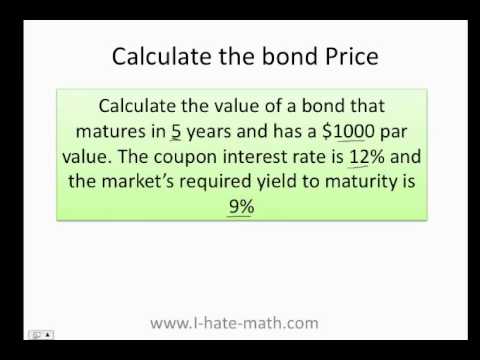

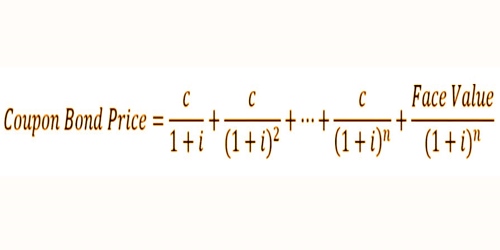

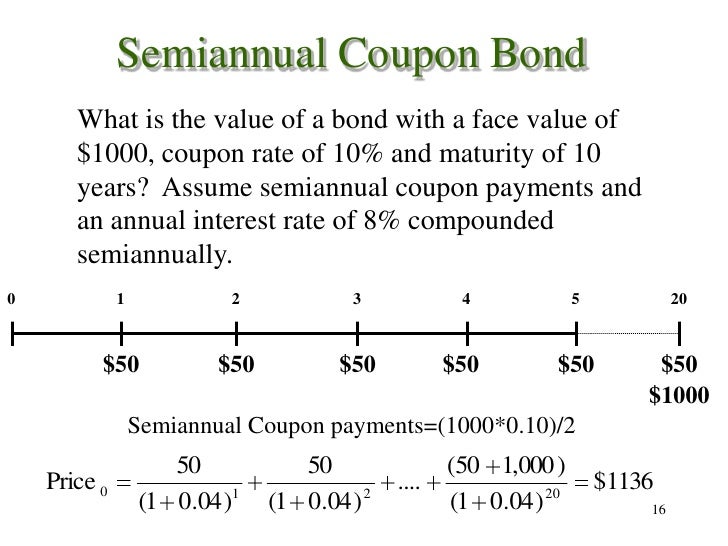

Bond Yield Formula | Step by Step Calculation & Examples The bond yield formula evaluates the returns from investment in a given bond. It is calculated as the percentage of the annual coupon payment to the bond price. The annual coupon payment is calculated by multiplying the bond’s face value with the coupon rate. How to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · Use the formula = (((/ (+))) /) + / ((+)), where, P = the bond price, C = the coupon payment, i = the yield to maturity rate, M = the face value and n = the total number of coupon payments. If you plug the 11.25 percent YTM into the formula to solve for P, the price, you get a price of $927.15.

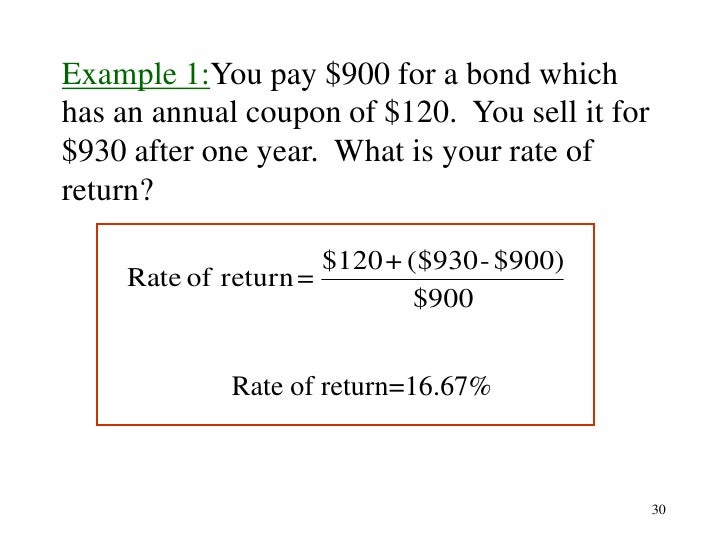

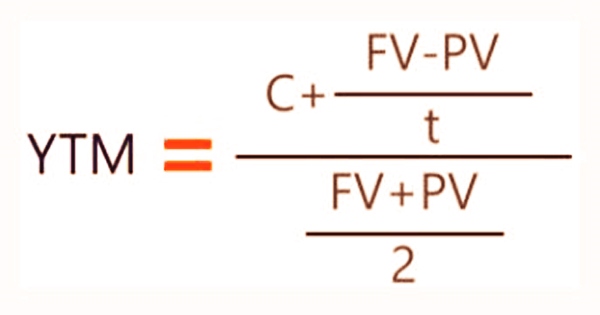

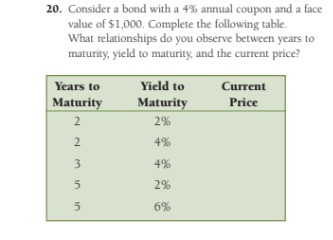

Bond Yield to Maturity (YTM) Calculator - DQYDJ Estimated Yield to Maturity Formula. However, that doesn't mean we can't estimate and come close. The formula for the approximate yield to maturity on a bond is: ( (Annual Interest Payment) + ( (Face Value - Current Price) / (Years to Maturity) ) ) / ( ( Face Value + Current Price ) / 2 ) Let's solve that for the problem we pose by default in ...

Yield to maturity of a coupon bond formula

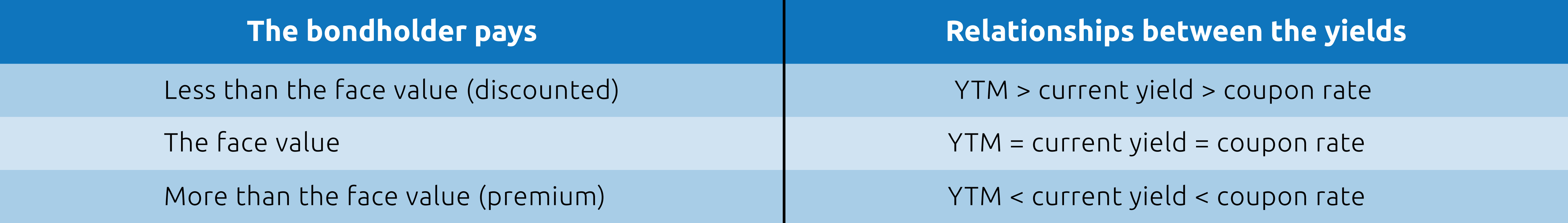

Yield to maturity - Wikipedia With 20 years remaining to maturity, the price of the bond will be 100/1.07 20, or $25.84. Even though the yield-to-maturity for the remaining life of the bond is just 7%, and the yield-to-maturity bargained for when the bond was purchased was only 10%, the annualized return earned over the first 10 years is 16.25%. What Is Bond Yield? - Investopedia May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... Yield to Maturity (YTM) Definition - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

Yield to maturity of a coupon bond formula. Yield to Maturity (YTM): Formula and Calculator [Excel Template] The coupon payments were reinvested at the same rate as the yield-to-maturity (YTM). Said differently, the yield to maturity (YTM) on a bond is its internal rate of return (IRR) – i.e. the discount rate which makes the present value (PV) of all the bond’s future cash flows equal to its current market price. Yield to Maturity (YTM) Formula Yield to Maturity (YTM) Definition - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... What Is Bond Yield? - Investopedia May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... Yield to maturity - Wikipedia With 20 years remaining to maturity, the price of the bond will be 100/1.07 20, or $25.84. Even though the yield-to-maturity for the remaining life of the bond is just 7%, and the yield-to-maturity bargained for when the bond was purchased was only 10%, the annualized return earned over the first 10 years is 16.25%.

Post a Comment for "40 yield to maturity of a coupon bond formula"