45 coupon rate for treasury bonds

Treasuries - WSJ Bonds & Rates; U.S. Treasury Quotes; View All Companies. U.S. Treasury Quotes. Treasury Notes & Bonds; Treasury Bills; Loading... We are in the process of updating our Market Data experience and ... HM Treasury - GOV.UK HM Treasury is the government’s economic and finance ministry, maintaining control over public spending, setting the direction of the UK’s economic policy and working to achieve strong and ...

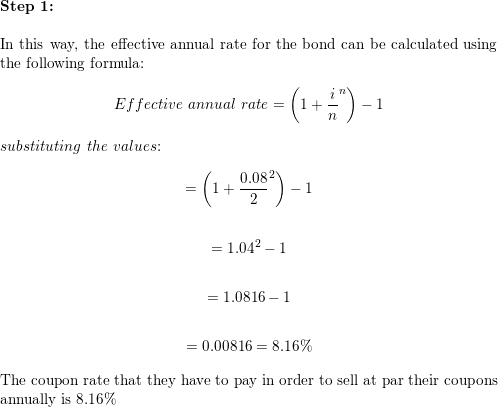

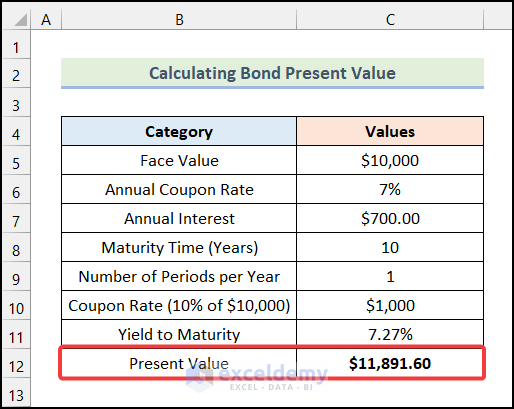

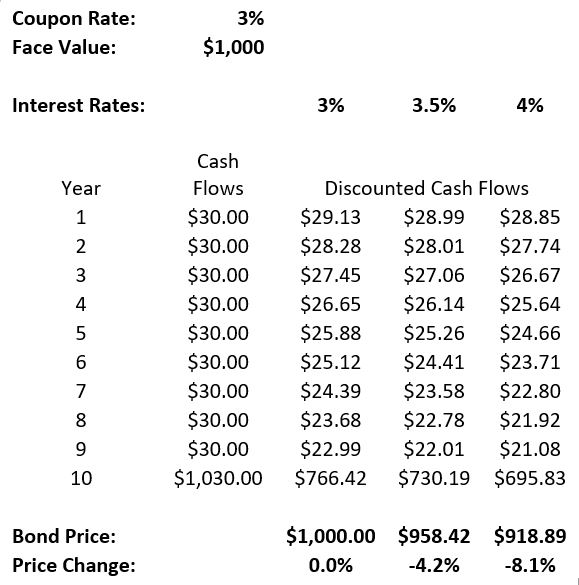

Bond Coupon Interest Rate: How It Affects Price - Investopedia 18.12.2021 · The coupon rate on a bond vis-a-vis prevailing market interest rates has a large impact on how bonds are priced. If a coupon is higher than the prevailing interest rate, the bond's price rises; if ...

Coupon rate for treasury bonds

Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers. The Basics of Bonds - Investopedia Jul 31, 2022 · Bonds (T-bonds) issued by the Treasury with a year or less to maturity are called “Bills”; bonds issued with 1 to 10 years to maturity are called “notes”; and bonds issued with more than ... Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

Coupon rate for treasury bonds. Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond's coupon rate is the periodic distribution the holder receives. ... However, for non-callable bonds such as U.S. Treasury bonds, the yield calculation used is a yield to maturity. In other ... United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Coupon Price Yield 1 Month 1 Year Time (EST) GB3:GOV . 3 Month . ... Rate Current 1 Year Prior; FDFD:IND ... Advantages and Risks of Zero Coupon Treasury Bonds 31.01.2022 · Persistently high inflation is often accompanied by repeated interest rate hikes, which would cause significant losses for zero-coupon Treasury bonds. On top of that, inflation reduces the value ... Bond (finance) - Wikipedia The coupon is the interest rate that the issuer pays to the holder. For fixed rate bonds, the coupon is fixed throughout the life of the bond. For floating rate notes, the coupon varies throughout the life of the bond and is based on the movement of a money market reference rate (often LIBOR).

MBS Dashboard - MBS Prices, Treasuries and Analysis This intraday rate trend tracker is intended to provide an idea of the general direction in MBS that may influence mortgage rates today. MBS Commentary Mon, Nov 21 2022, 3:41 PM Zero-Coupon Bond: Definition, How It Works, and How To Calculate 31.05.2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Treasury Bonds: A Good Investment for Retirement? - Investopedia 25.05.2022 · Bonds including, T-bonds, can be a good investment for those who are seeking a steady rate of interest payments. Although bonds and Treasury bonds are popular, they have some disadvantages and ... Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

The Basics of Bonds - Investopedia Jul 31, 2022 · Bonds (T-bonds) issued by the Treasury with a year or less to maturity are called “Bills”; bonds issued with 1 to 10 years to maturity are called “notes”; and bonds issued with more than ... Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers.

Post a Comment for "45 coupon rate for treasury bonds"