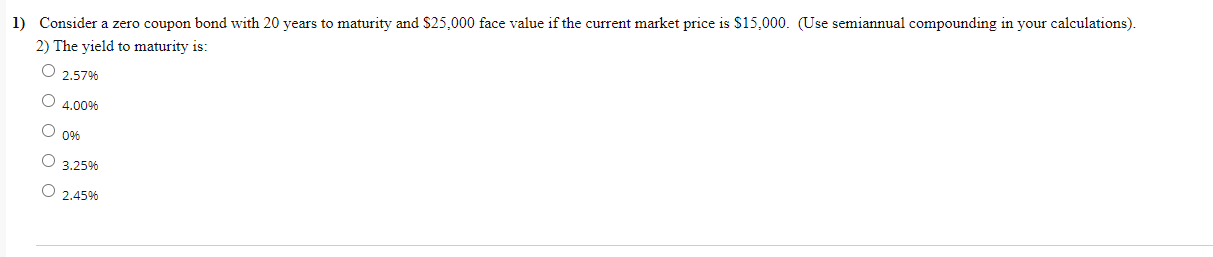

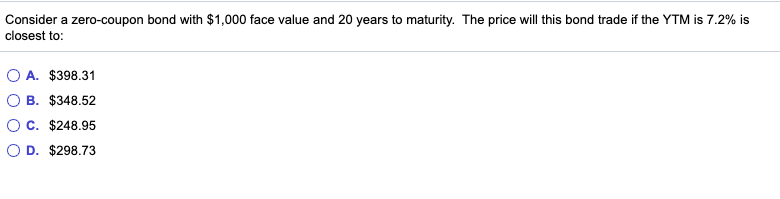

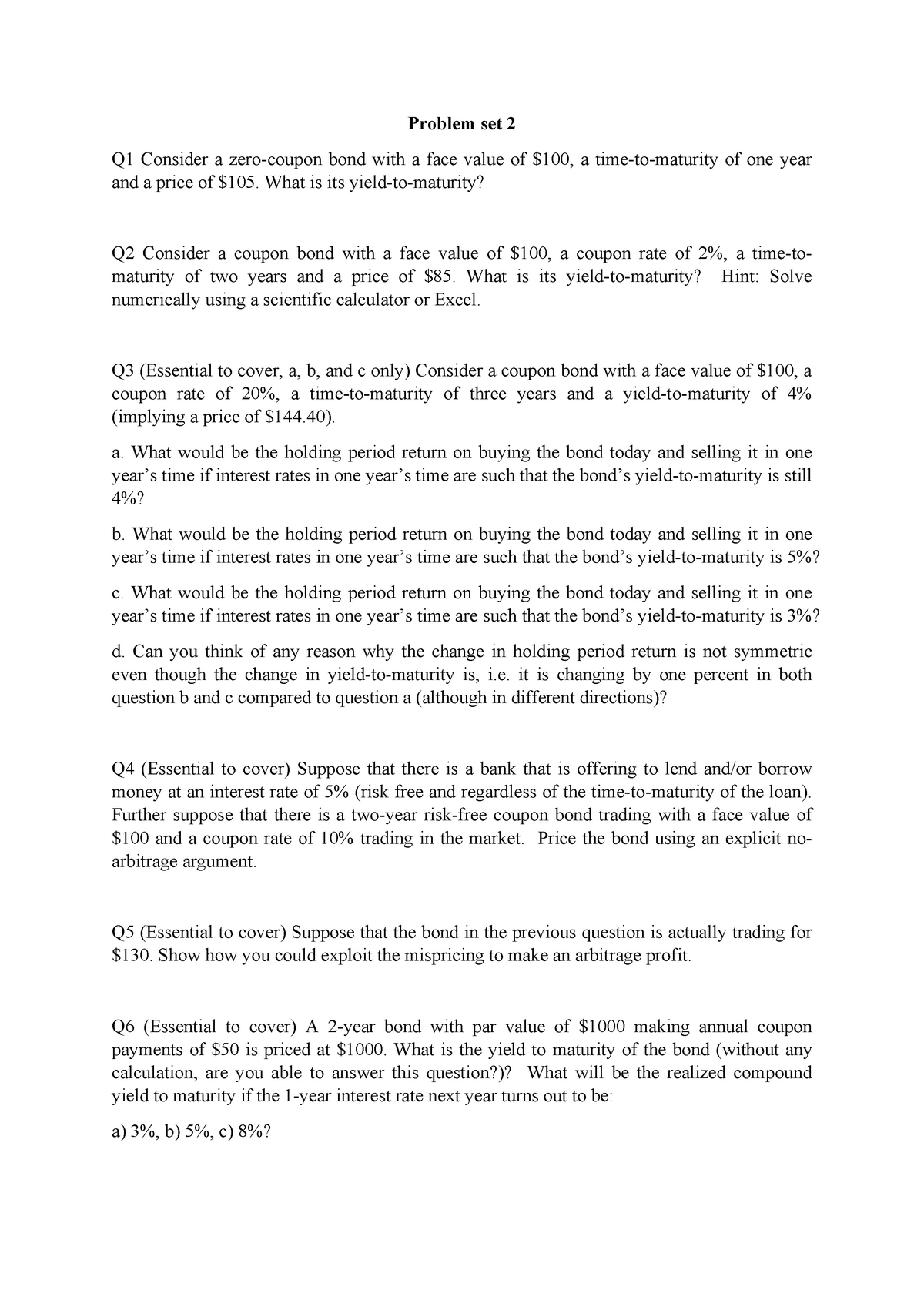

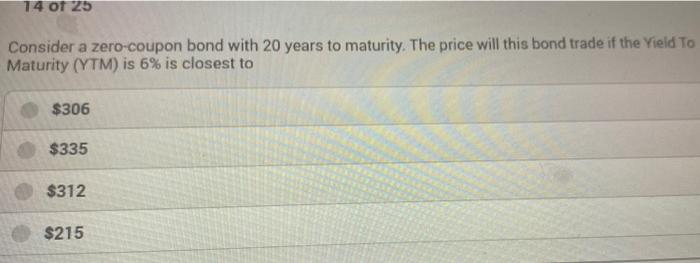

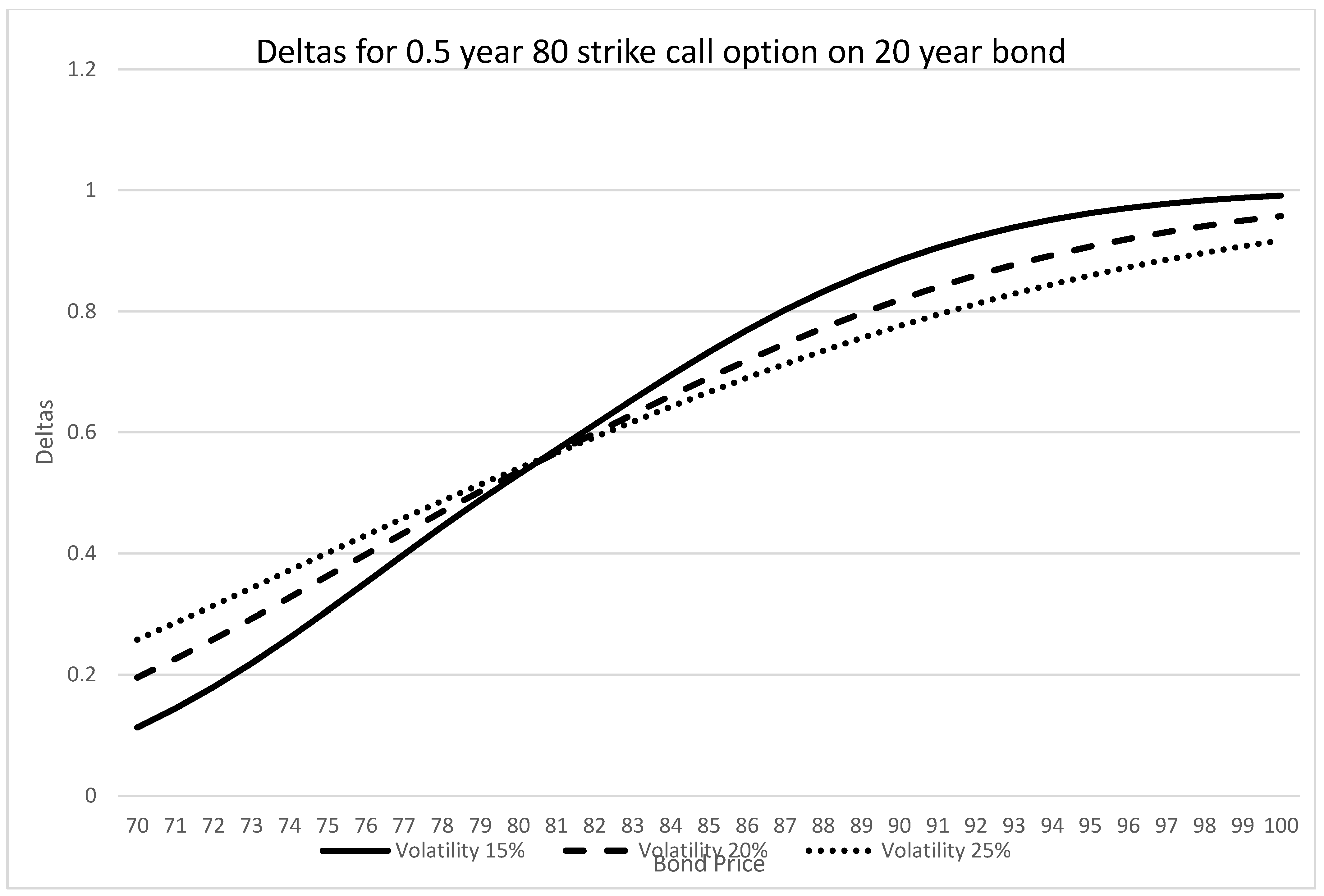

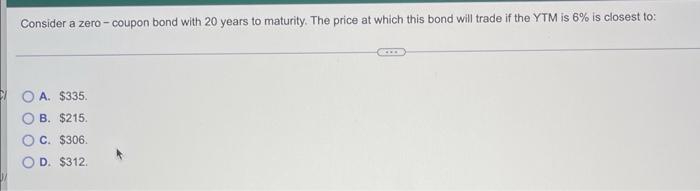

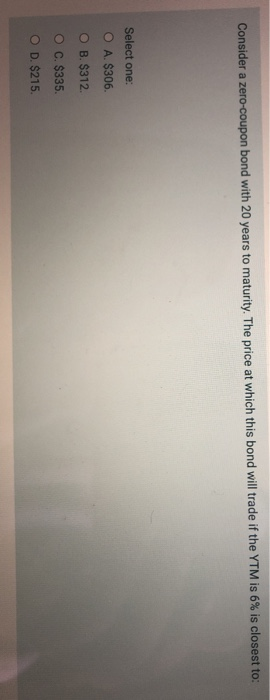

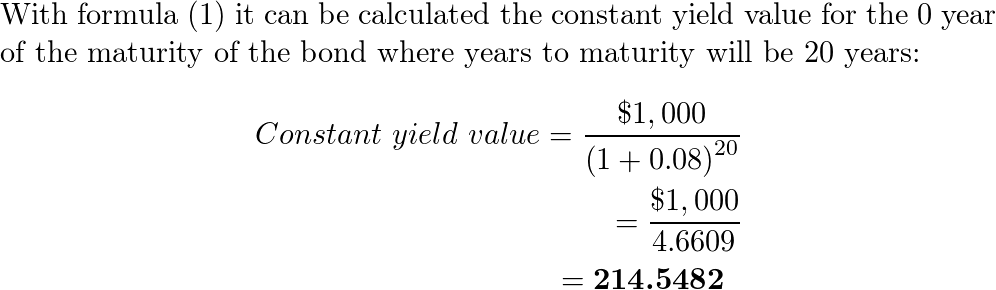

44 consider a zero coupon bond with 20 years to maturity

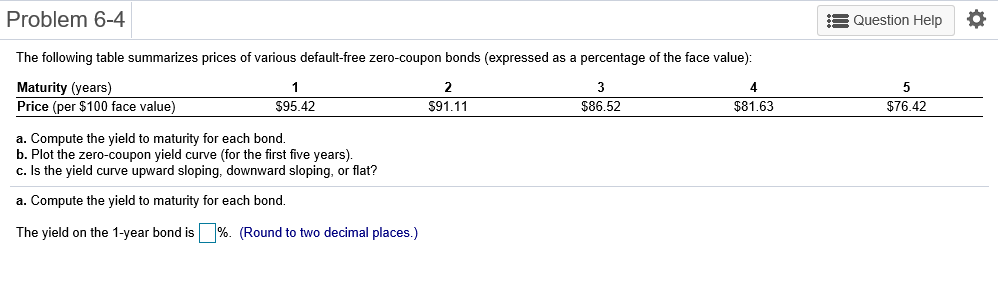

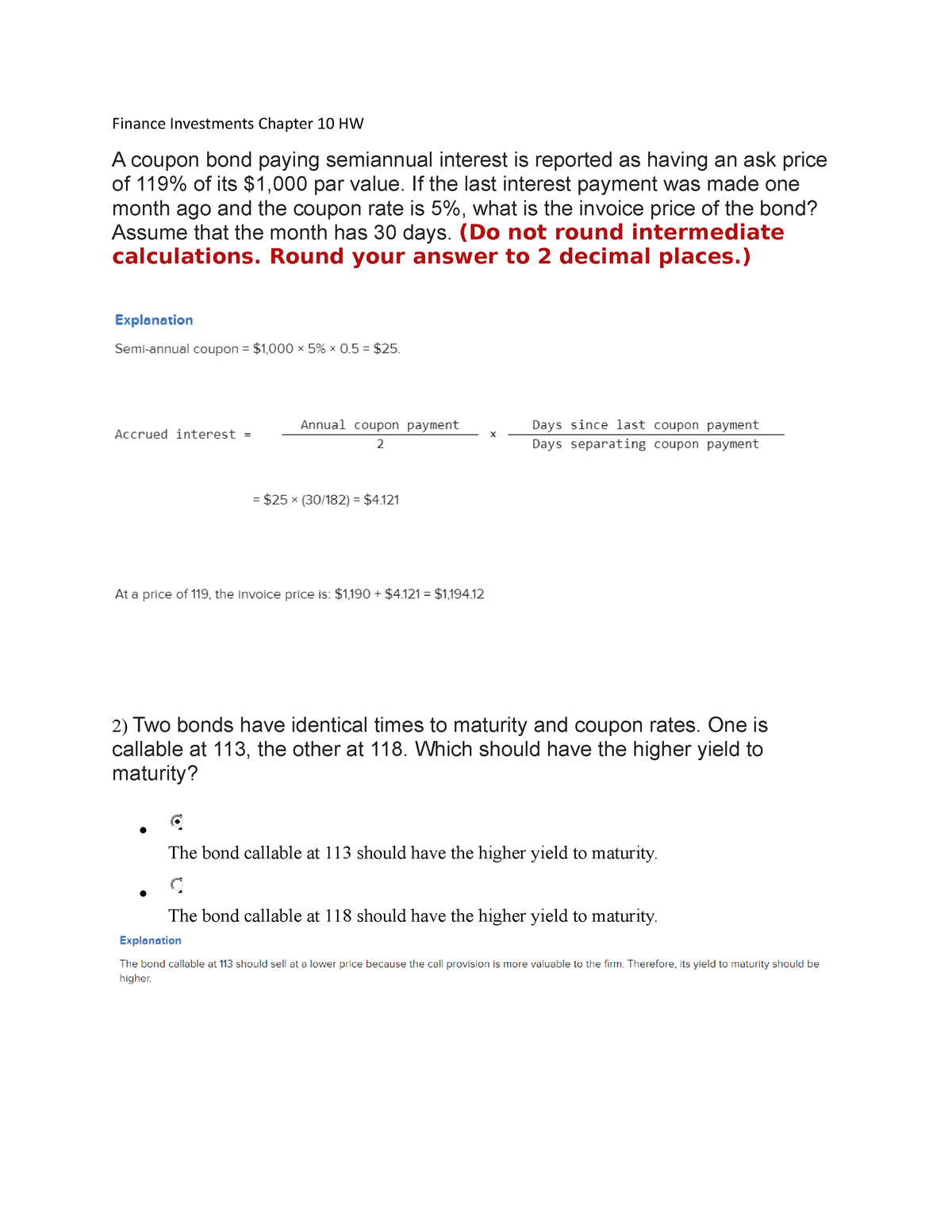

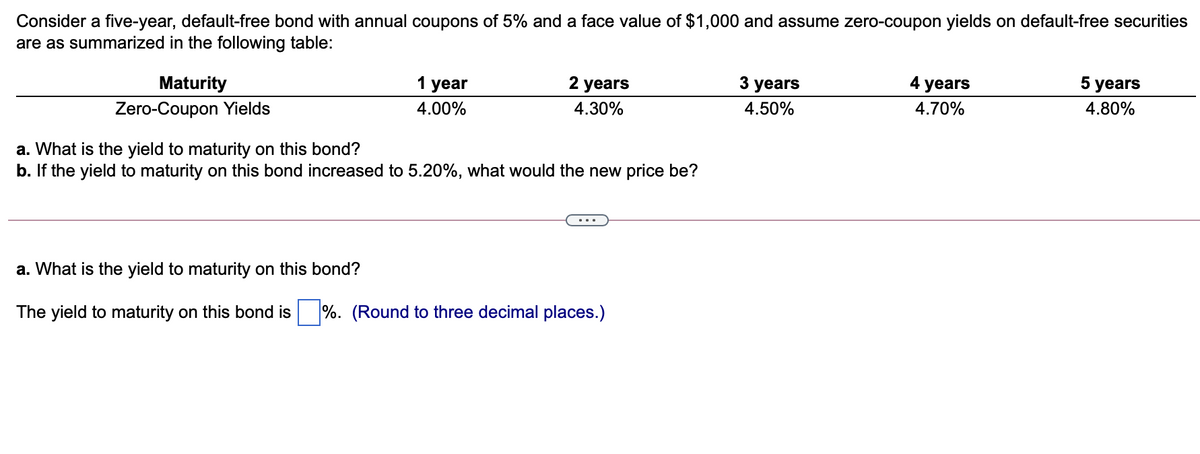

› calcs › bondsBond Yield to Maturity Calculator for Comparing Bonds Let's say you buy a 10 year $1000 bond with a 5% coupon. You hold that bond for the next few years collecting your $50 of annual interest. During that time, interest rates fall, and a comparable 10 year $1000 bond now carries a 4% coupon. Your original bond is now a much more valuable commodity, and it can be sold at a premium on the open market. › publications › p550Publication 550 (2021), Investment Income and Expenses ... One-fourth of 1% of $1,000 (stated redemption price) times 10 (the number of full years from the date of original issue to maturity) equals $25. Because the $20 discount is less than $25, the OID is treated as zero. (If you hold the bond at maturity, you will recognize $20 ($1,000 − $980) of capital gain.)

Could Call of Duty doom the Activision Blizzard deal? - Protocol 14.10.2022 · Hello, and welcome to Protocol Entertainment, your guide to the business of the gaming and media industries. This Friday, we’re taking a look at Microsoft and Sony’s increasingly bitter feud over Call of Duty and whether U.K. regulators are leaning toward torpedoing the Activision Blizzard deal.

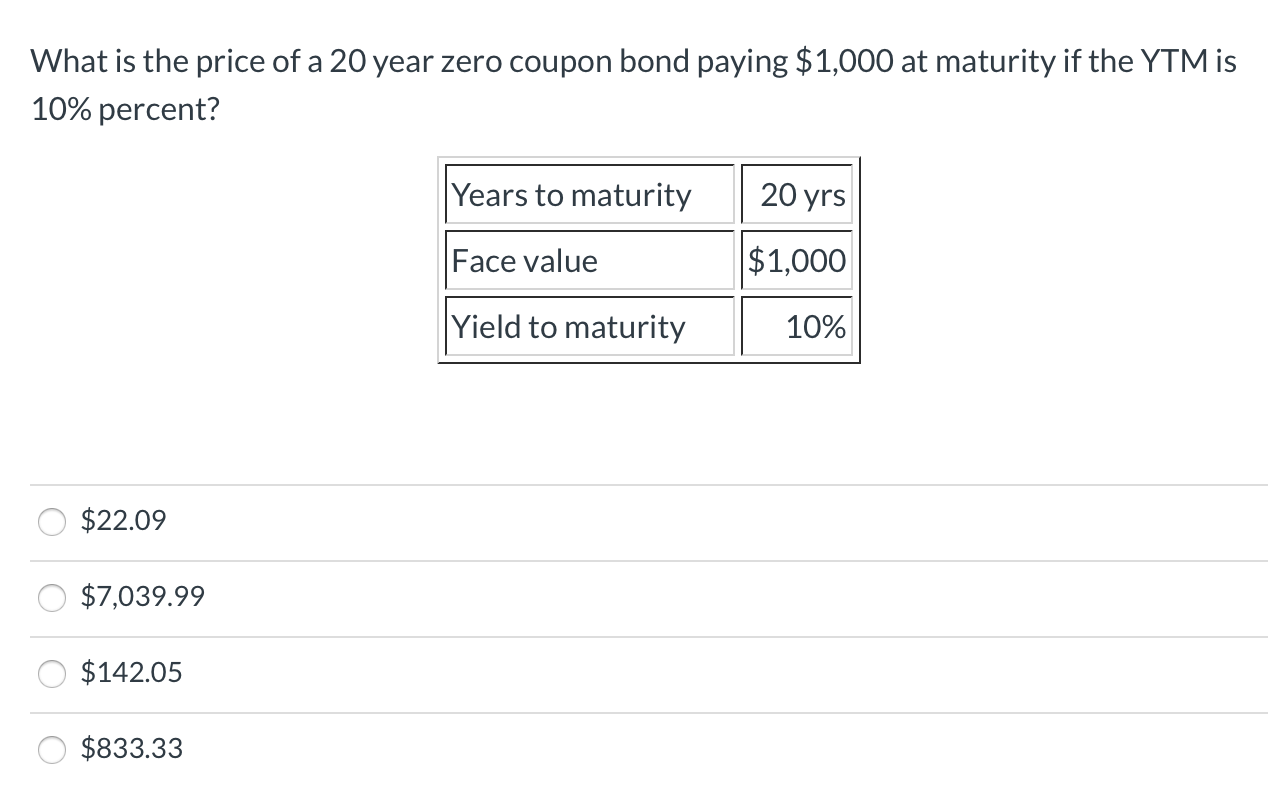

Consider a zero coupon bond with 20 years to maturity

Publication 17 (2021), Your Federal Income Tax - Internal … Form 8915-F replaces Form 8915-E. Form 8915-F replaces Form 8915-E for reporting qualified 2020 disaster distributions and repayments of those distributions made in 2021 and 2022, as applicable, unlike in previous disaster years where distributions and repayments would be reported on the applicable Form 8915 for that year's disasters. For example, Form 8915-D, … › newsLatest Business News | BSE | IPO News - Moneycontrol Nov 10, 2022 · Latest News. Get all the latest India news, ipo, bse, business news, commodity only on Moneycontrol. › terms › cWhat Is a Certificate of Deposit (CD) and What Can It Do for You? May 18, 2022 · Certificate Of Deposit - CD: A certificate of deposit (CD) is a savings certificate with a fixed maturity date , specified fixed interest rate and can be issued in any denomination aside from ...

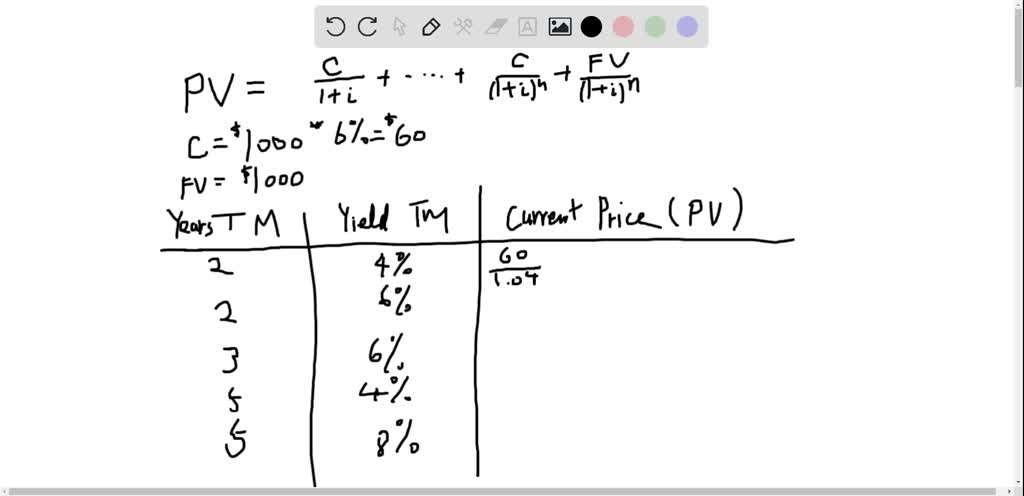

Consider a zero coupon bond with 20 years to maturity. Latest News | Latest Business News | BSE | IPO News - Moneycontrol… Latest News. Get all the latest India news, ipo, bse, business news, commodity only on Moneycontrol. Bond (finance) - Wikipedia In finance, a bond is a type of security under which the issuer owes the holder a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time.The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. › 2022/10/19 › 23411972Microsoft is building an Xbox mobile gaming store to take on ... Oct 19, 2022 · In a graph posted at Microsoft’s Activision Blizzard acquisition site, the company depicts the entire gaming market as worth $165 billion in 2020, with consoles making up $33 billion (20 percent ... Understanding Bond Prices and Yields - Investopedia 28.06.2007 · If you buy a bond at issuance, the bond price is the face value of the bond, and the yield will match the coupon rate of the bond. That is, if you buy a bond that pays 1% interest for three years ...

› createJoin LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols; All the 21 Types of Bonds | General Features and Valuation | eFM 13.06.2022 · It is also known as a straight bond or a bullet bond. Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor. › de › jobsFind Jobs in Germany: Job Search - Expatica Germany Browse our listings to find jobs in Germany for expats, including jobs for English speakers or those in your native language. What Is the Coupon Rate of a Bond? - The Balance 18.11.2021 · Another type of bond is a zero coupon bond, which does not pay interest during the time the bond is outstanding. Rather, zero coupon bonds are sold at a discount to their value at maturity. Maturity dates on zero coupon bonds tend to be long term, often not maturing for 10, 15, or more years.

Achiever Papers - We help students improve their academic standing 10+ years in academic writing. 515 writers active. 97.12% orders delivered before the deadline. 8.5 / 10 average quality score from customers. What advantages do you get from our Achiever Papers' services? All our academic papers are written from scratch. All our clients are privileged to have all their academic papers written from scratch. These papers are also written according … › terms › cWhat Is a Certificate of Deposit (CD) and What Can It Do for You? May 18, 2022 · Certificate Of Deposit - CD: A certificate of deposit (CD) is a savings certificate with a fixed maturity date , specified fixed interest rate and can be issued in any denomination aside from ... › newsLatest Business News | BSE | IPO News - Moneycontrol Nov 10, 2022 · Latest News. Get all the latest India news, ipo, bse, business news, commodity only on Moneycontrol. Publication 17 (2021), Your Federal Income Tax - Internal … Form 8915-F replaces Form 8915-E. Form 8915-F replaces Form 8915-E for reporting qualified 2020 disaster distributions and repayments of those distributions made in 2021 and 2022, as applicable, unlike in previous disaster years where distributions and repayments would be reported on the applicable Form 8915 for that year's disasters. For example, Form 8915-D, …

Post a Comment for "44 consider a zero coupon bond with 20 years to maturity"