43 ytm zero coupon bond

Current Yield vs. Yield to Maturity - Investopedia Oct 12, 2022 · The current yield of a bond is calculated by dividing the annual coupon payment by the bond's current ... its current yield and YTM are lower than its coupon ... to Maturity of a Zero-Coupon Bond. Par Yield Curve: Definition, Calculation, Vs. Spot Curve Dec 14, 2020 · Par Yield Curve: A par yield curve is a graph of the yields on hypothetical Treasury securities with prices at par. On the par yield curve, the coupon rate will equal the yield-to-maturity of the ...

How to Invest in Bonds | The Motley Fool Nov 24, 2022 · For example, you might buy a 10-year, $10,000 bond paying 3% interest. In exchange, your town will promise to pay you interest on that $10,000 every six months and then return your $10,000 after ...

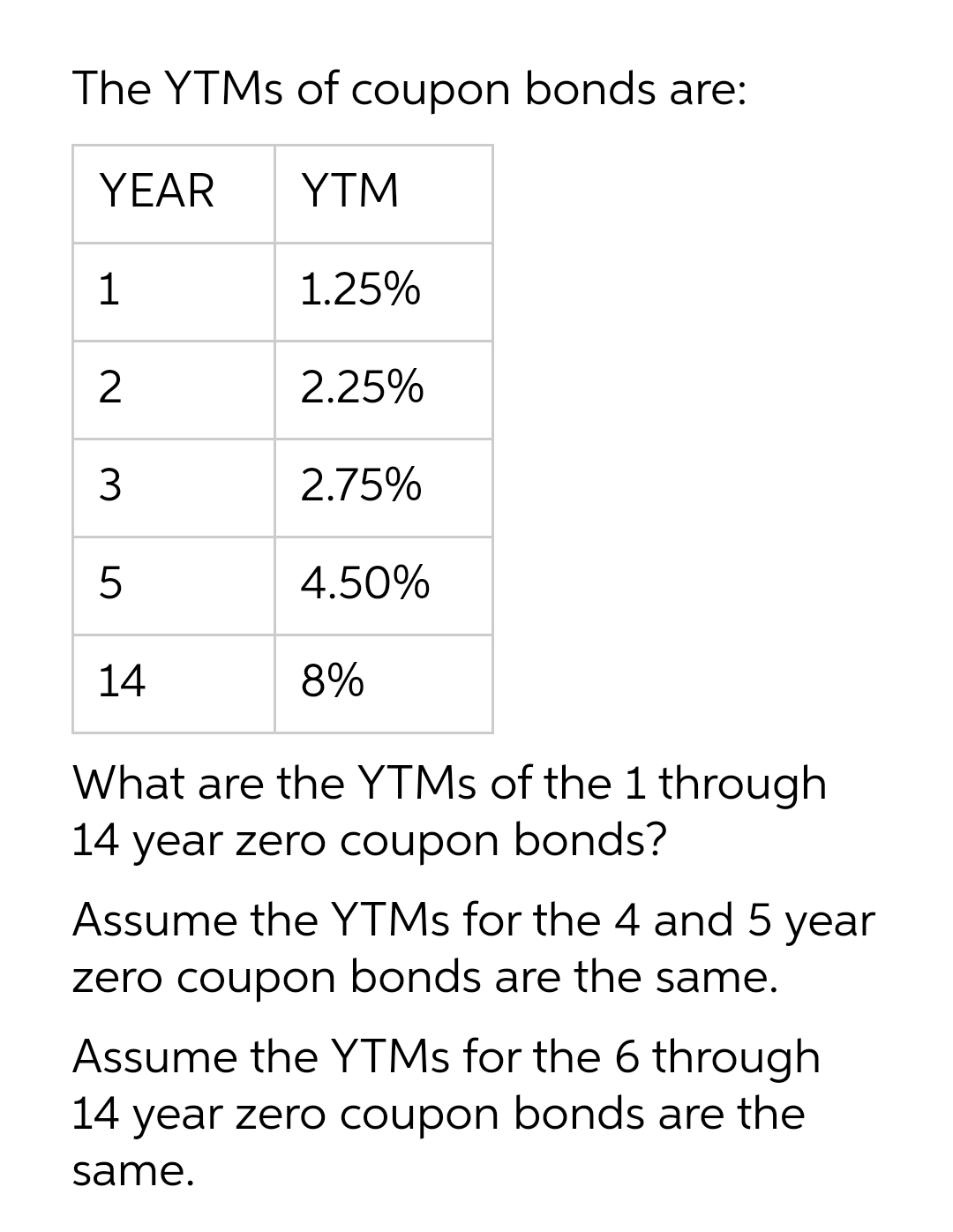

Ytm zero coupon bond

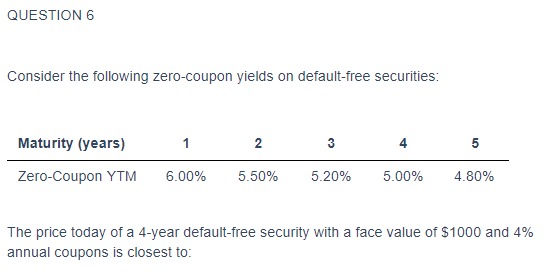

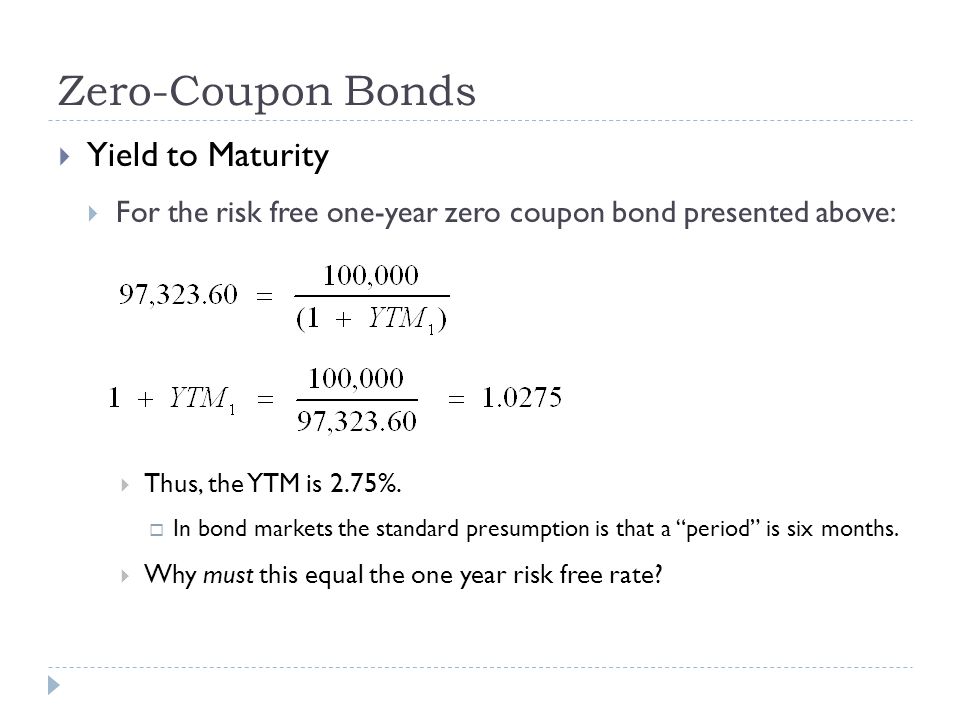

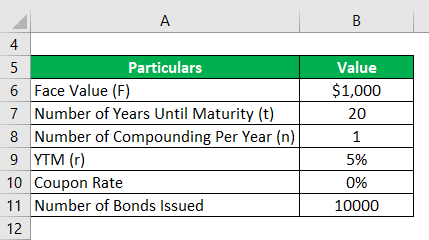

Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ... Zero-Coupon Bond - Wall Street Prep Zero-Coupon Bond Yield-to-Maturity (YTM) Formula The yield-to-maturity (YTM) is the rate of return received if an investor purchases a bond and proceeds to hold onto it until maturity. In the context of zero-coupon bonds, the YTM is the discount rate (r) that sets the present value (PV) of the bond’s cash flows equal to the current market price. 4 Basic Things to Know About Bonds - Investopedia Oct 24, 2022 · Calculating YTM by hand is a lengthy procedure, so it is best to use Excel’s RATE or YIELDMAT functions (starting with Excel 2007). ... How to Calculate Yield to Maturity of a Zero-Coupon Bond ...

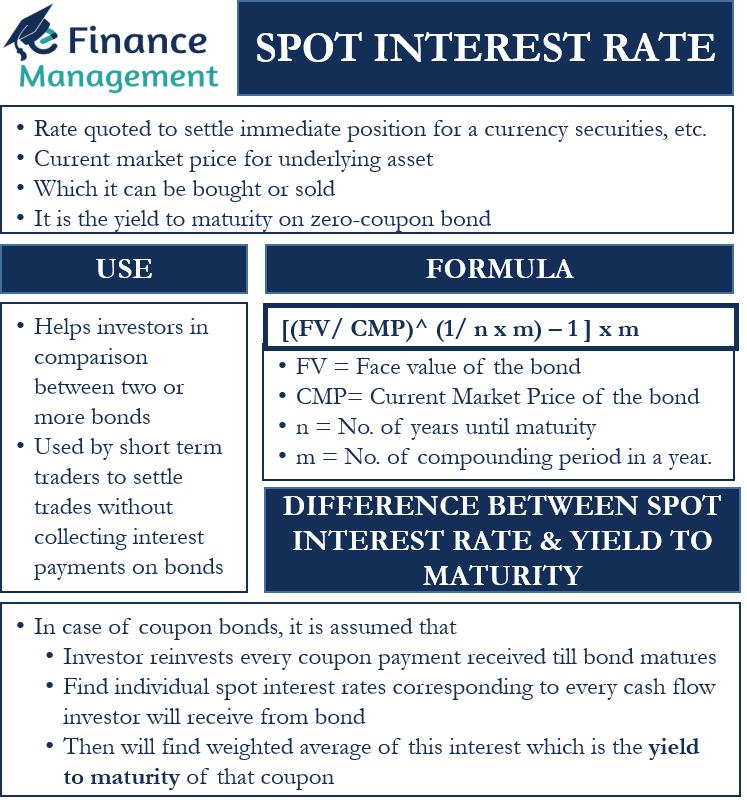

Ytm zero coupon bond. Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... 4 Basic Things to Know About Bonds - Investopedia Oct 24, 2022 · Calculating YTM by hand is a lengthy procedure, so it is best to use Excel’s RATE or YIELDMAT functions (starting with Excel 2007). ... How to Calculate Yield to Maturity of a Zero-Coupon Bond ... Zero-Coupon Bond - Wall Street Prep Zero-Coupon Bond Yield-to-Maturity (YTM) Formula The yield-to-maturity (YTM) is the rate of return received if an investor purchases a bond and proceeds to hold onto it until maturity. In the context of zero-coupon bonds, the YTM is the discount rate (r) that sets the present value (PV) of the bond’s cash flows equal to the current market price. Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ...

Post a Comment for "43 ytm zero coupon bond"