39 us treasury bonds coupon rate

I bonds — TreasuryDirect Current Interest Rate Series I Savings Bonds 9.62% For savings bonds issued May 1, 2022 to October 31, 2022. Complete the purchase of this bond in TreasuryDirect by October 28, 2022 to ensure issuance by October 31, 2022. I bonds at a Glance How do I ... for a Series I savings bond Buy EE or I savings bonds Cash in (redeem) an EE or I savings bond Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers.

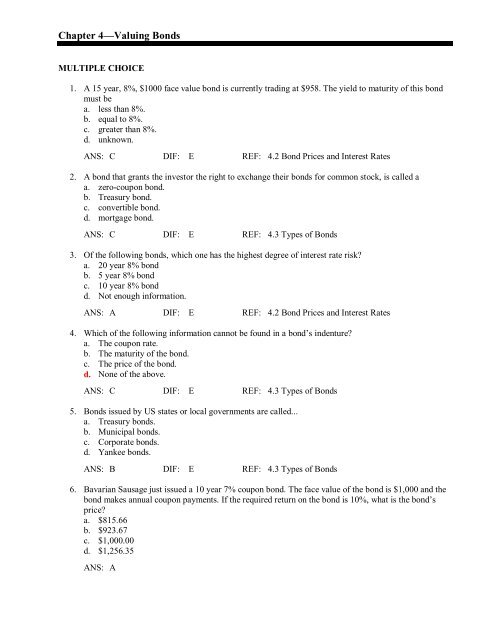

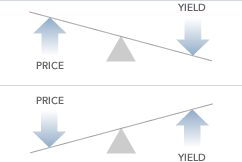

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a...

Us treasury bonds coupon rate

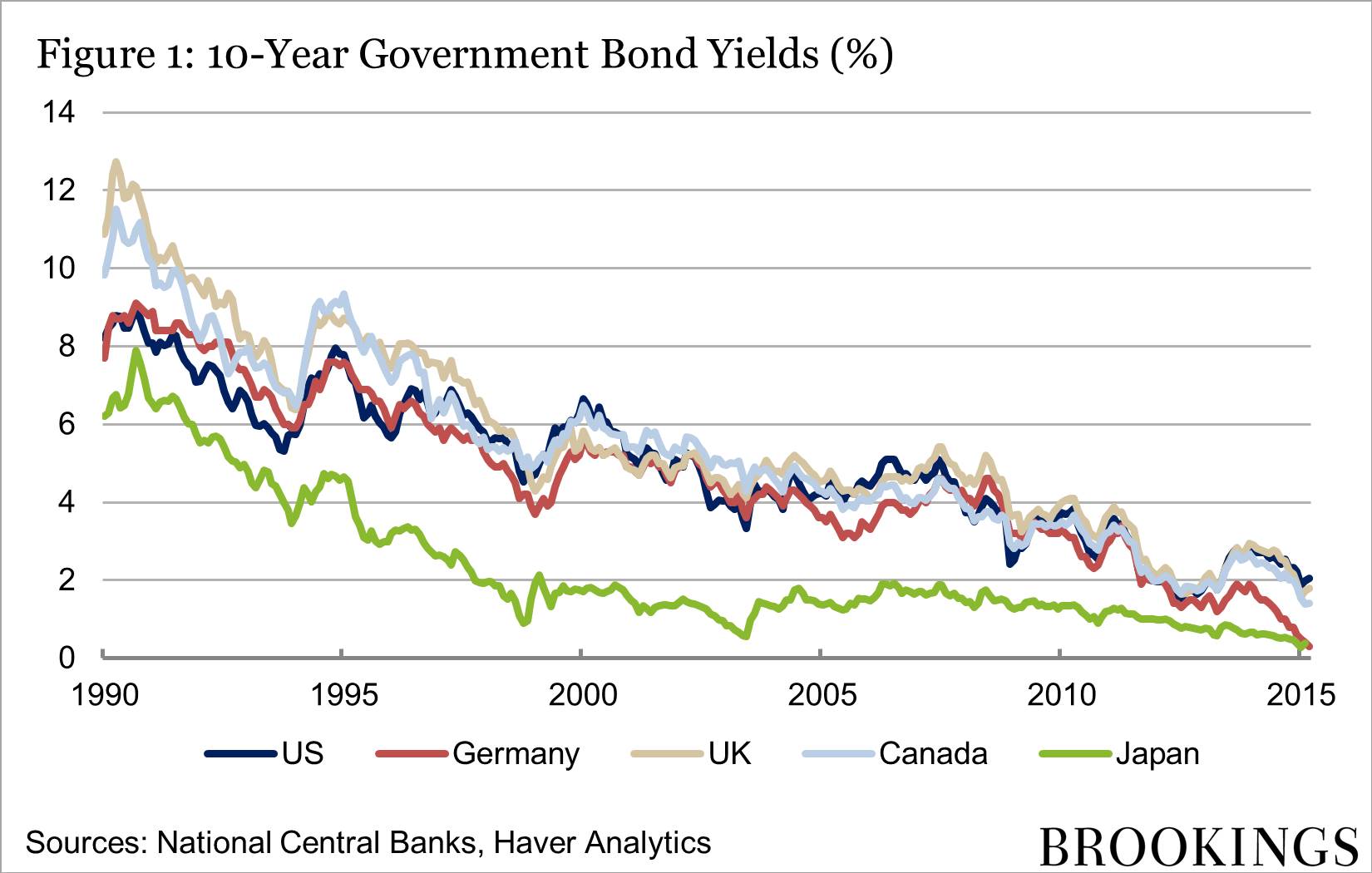

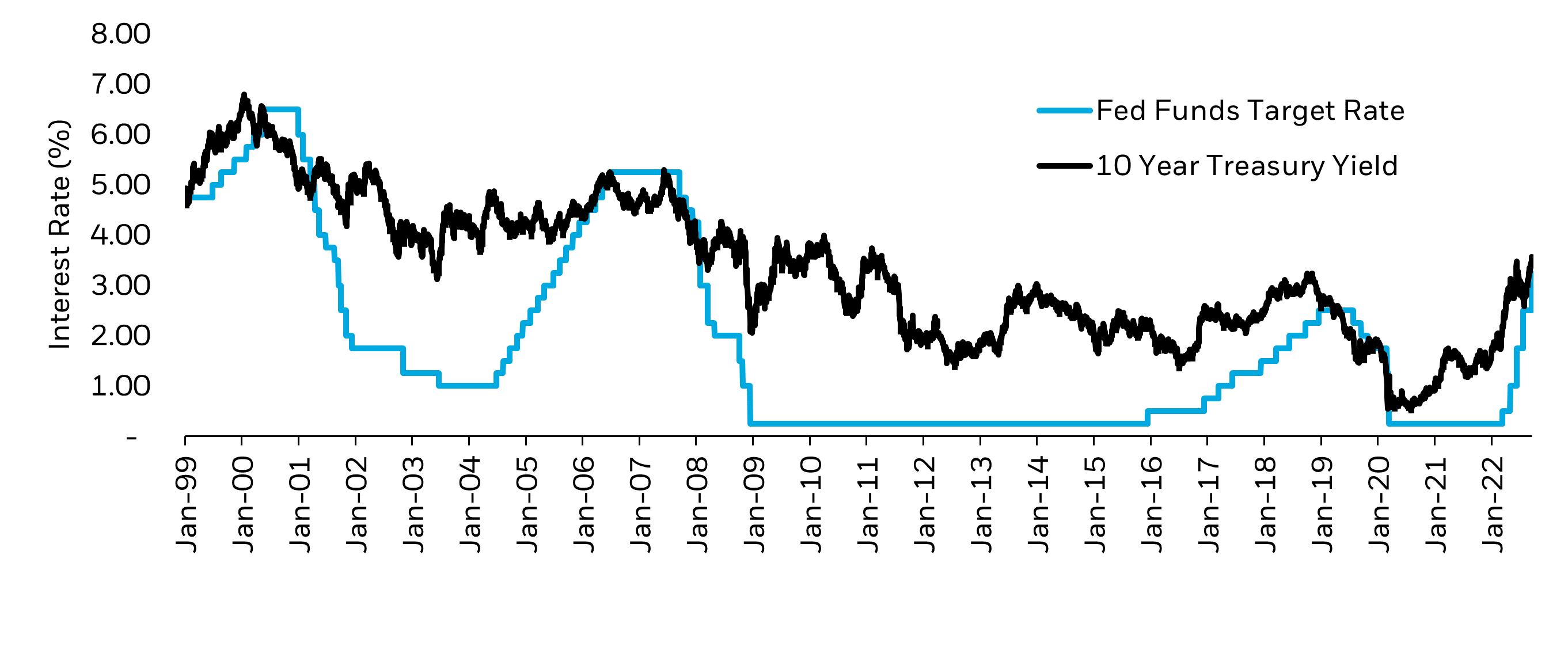

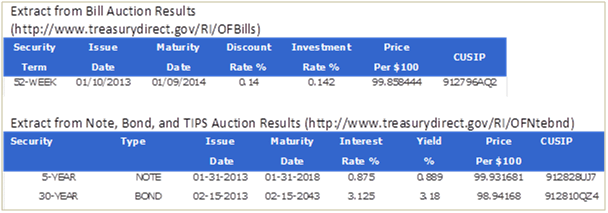

10 Year Treasury Rate - YCharts Many analysts will use the 10 year yield as the "risk free" rate when valuing the markets or an individual security. Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury Rate is at 4.02%, compared to 3.96% the previous market day and 1.57% last year. How does the U.S. Treasury decide what coupon rate to offer on Treasury ... E.g. if the implied 10yr Trsy yield is 2.03% when the auction happens, the Treasury would set the coupon as 2%. Simple as that. If the coupon were set to 6%, the bond would trade at a huge premium. If the coupon were set to .5%, it would trade at a huge discount. Par is good, because then the dollar value of the Continue Reading More answers below US Treasury Series I Savings Bonds Inflation Rate Earnings (May ... 728,462 Views 1,930 Comments. U.S. Government Treasury is currently offering 9.62% Interest Rate (Annualized for 6 Months) in combined Fixed + Inflation Rate Earnings valid on newly issued Series I Savings Bonds purchased from May through October 2022. Limit of $10,000/year per person. Thanks to Community Member Libertarian for posting this offer.

Us treasury bonds coupon rate. Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face... United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 4.016% yield. 10 Years vs 2 Years bond spread is -40.8 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 3.25% (last modification in September 2022). The United States credit rating is AA+, according to Standard & Poor's agency. Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security. I bonds interest rates — TreasuryDirect Current Interest Rate Series I Savings Bonds 6.89% For savings bonds issued November 1, 2022 to April 30, 2023. Fixed rate You know the fixed rate of interest that you will get for your bond when you buy the bond. The fixed rate never changes. We announce the fixed rate every May 1 and November 1.

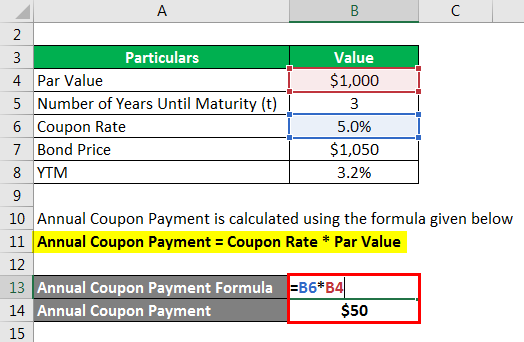

Coupon Rate of a Bond - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate ... Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ... Treasury Coupon Bonds - Economy Watch Treasury Coupon bonds are bonds issued by the US Treasury that come with semi-annual interest payments while the face values of the bonds are paid upon maturity. Compared to other types of negotiable bond issues, Treasury coupon bonds come with more frequent interest payments. Other types of bonds offer interest income on annual or biannual basis. Coupon Rate On Us Treasury Bonds - csatlosklaudia.hu Coupon rate on us treasury bonds. Thinking about packing your bags and heading off to Austria? I paied 40 dollors for express delivery 1week but they just sent me the accessories! We were sent to another line to pay then back to check in. View All prev 1 of 4 next. When excessive engine braking occurs ?

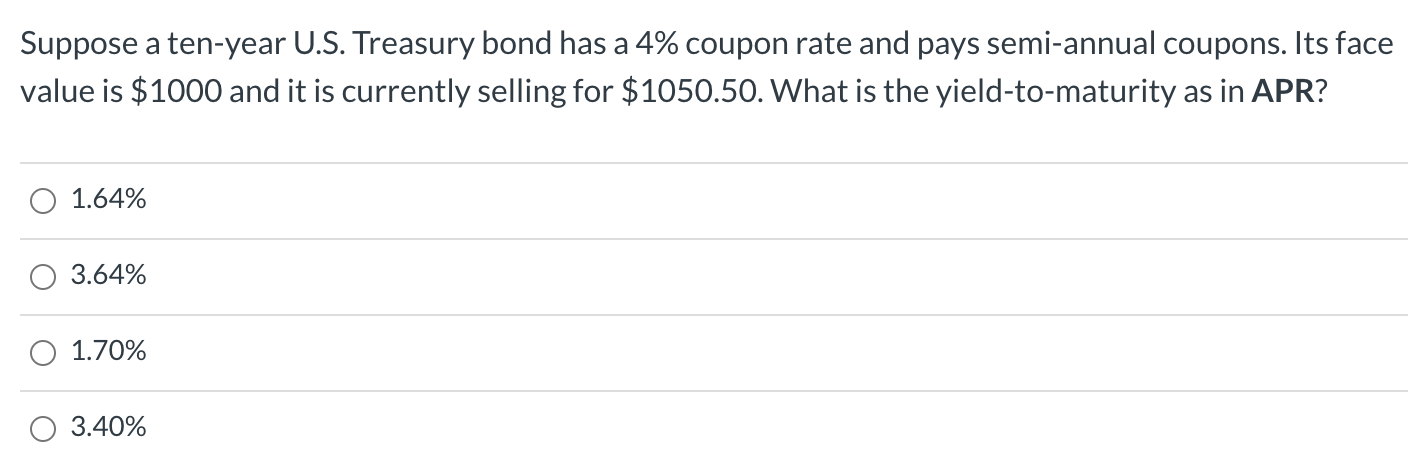

10-Year Treasury Note and How It Works - The Balance 0.06% on the one-month Treasury bill 0.06% on the three-month bill 0.73% on the two-year Treasury note 1.52% on the 10-year note 1.93% on the 30-year Treasury bond Frequently Asked Questions (FAQs) How can I buy a 10-year Treasury note? You can buy Treasury notes on the TreasuryDirect website in $100 increments. Are most US treasury bonds which pay coupons of fixed interest rates ... Answer (1 of 5): Yes, most conventional Treasury bonds are issued with a coupon that is fixed for the life of the bond. For example, a 3% coupon bond will pay $15 in interest every 6 months—$30 per year on a bond with $1000 face value— no matter what. But there are exceptions: * Bonds that ma... Bonds | FINRA.org Another rate that heavily influences a bond's coupon is the Fed's Discount Rate, which is the rate at which member banks may borrow short-term funds from a Federal Reserve Bank. ... Treasury Bond A Treasury bond is a long-term debt security issued by the U.S. government with a maturity of 10 to 30 years, paying a fixed interest rate ... Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate.

US Treasury Zero-Coupon Yield Curve - NASDAQ US Treasury Zero-Coupon Yield Curve From the data product: US Federal Reserve Data Releases (60,778 datasets) Refreshed 16 hours ago, on 1 Nov 2022 Frequency daily Description These yield...

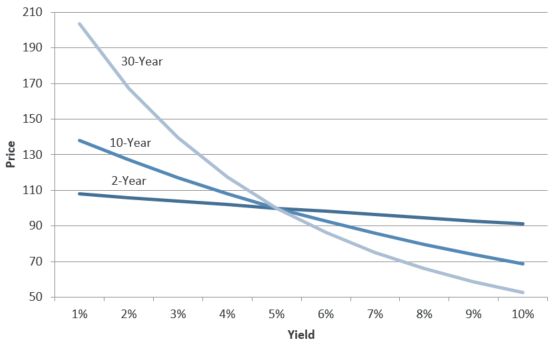

10-Year US Treasury Note - Guide, Examples, Importance of 10-Yr Notes The 10-year US T-note is one of the most tracked treasury yields in the United States. Investors can assess the performance of the economy by looking at the Treasury yield curve. The yield curve is a graphic representation of all yields starting from the one-month T-bill to 30-year T-bond. The 10-year T-note is located in the middle of the ...

United States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year

U.S. Treasury Bond Options Quotes - CME Group 30-Year Treasury CVOL Index. Track forward-looking risk expectations on 30-Year Treasuries with the CME Group Volatility Index (CVOLTM), a robust measure of 30-day implied volatility derived from deeply liquid options on 30-Year U.S. Treasury Bond futures. CODE:

How Often do Treasury Bonds Pay Interest? | Fox Business A 30-year U.S. Treasury bond falls into that category. The most recently issued 30-year bond has a 2.75% coupon. The coupon rate determines the interest payments. The 2.75% is the...

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value...

TMUBMUSD20Y | U.S. 20 Year Treasury Bond Overview | MarketWatch Coupon Rate 3.375% Maturity Aug 15, 2042 Performance Change in Basis Points Recent News MarketWatch 7- and 20-year Treasury yields touch 4%, as 2- and 3-year rates go above 4.2% Sep. 26,...

U.S. Treasury Confirms I Bonds Will Pay A 9.62% Interest Rate - Forbes With inflation increasing this year to multi-decade highs, I Bonds bought from May until Monday, October 31, will pay an annualized interest rate of 9.62%. Keep in mind that the 9.62% rate is...

Us Treasury Bond Coupon Rate - bizimkonak.com Us Treasury Bond Coupon Rate. Home; Us treasury bond coupon rate; Listing Websites about Us Treasury Bond Coupon Rate. Filter Type: All $ Off % Off Free Shipping US Treasury Bonds - Fidelity. CODES (8 days ago) Web7 rows · US Treasury bonds: $1,000: Coupon: 20-year 30-year: Interest paid semi ...

Important Differences Between Coupon and Yield to Maturity - The Balance For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. This means that an investor who buys the bond and owns it until 2049 can expect to receive 2% per year for the life of the bond, or $20 for every $1000 they invested. However, many bonds trade in the open market after they're issued.

TMUBMUSD01Y | U.S. 1 Year Treasury Bill Overview | MarketWatch Coupon Rate 0.000% Maturity Oct 5, 2023 Performance Change in Basis Points Yield Curve - US Recent News MarketWatch Treasury yields rack up biggest weekly declines in months as Fed's next...

US Treasury Series I Savings Bonds Inflation Rate Earnings (May ... 728,462 Views 1,930 Comments. U.S. Government Treasury is currently offering 9.62% Interest Rate (Annualized for 6 Months) in combined Fixed + Inflation Rate Earnings valid on newly issued Series I Savings Bonds purchased from May through October 2022. Limit of $10,000/year per person. Thanks to Community Member Libertarian for posting this offer.

How does the U.S. Treasury decide what coupon rate to offer on Treasury ... E.g. if the implied 10yr Trsy yield is 2.03% when the auction happens, the Treasury would set the coupon as 2%. Simple as that. If the coupon were set to 6%, the bond would trade at a huge premium. If the coupon were set to .5%, it would trade at a huge discount. Par is good, because then the dollar value of the Continue Reading More answers below

10 Year Treasury Rate - YCharts Many analysts will use the 10 year yield as the "risk free" rate when valuing the markets or an individual security. Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury Rate is at 4.02%, compared to 3.96% the previous market day and 1.57% last year.

:max_bytes(150000):strip_icc()/GettyImages-172745598-5756f5bd3df78c9b46977f64.jpg)

Post a Comment for "39 us treasury bonds coupon rate"