40 step up coupon bonds

Coupon Bond - Investopedia Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ... Singapore Savings Bonds Coupons | Invest Singapore Bonds Given the step-up coupons, average return varies across the holding period. The longer the investor holds the bond, the higher the average coupons or returns. This information is provided together with the coupon table for each bond issue. Investors should take note of this value together with current year coupon to evaluate bond redemption.

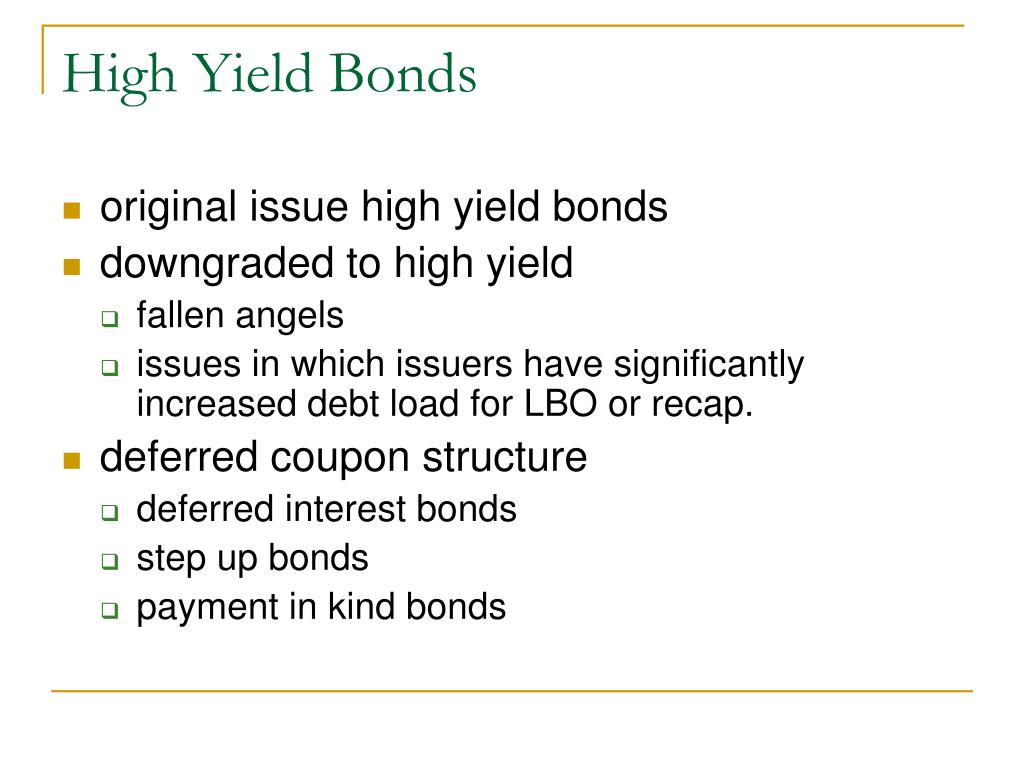

Deferred Coupon Bonds: Definition, How It Works, Types and More Step-Up Bonds These bonds do not make coupon payments until a certain period. For instance, a bond can start interest payments after 5 years with a 10 year maturity period. Toggle Notes Toggle notes pay increased interest rates after a certain period. Investors expect higher interest rates with a deferred payment condition.

Step up coupon bonds

Step Up Bonds: Pros and Cons - Management Study Guide Higher Yields: Step-up bonds are designed to provide guaranteed higher yields to investors. The bonds are created in such a way that the coupon payments in the last few years of the existence of the bonds are much larger than the expected interest rate during the same period. Stepped coupon bond - Financial Dictionary A bond with interest coupons that change to predetermined levels on specific dates. Thus, a stepped coupon bond might pay 9% interest for the first 5 years after issue and then step up the interest every fifth year until maturity. Issuers often have the right to call the bond at par on the date the interest rate is scheduled to change. Corporate Bonds - Fidelity Step-up coupon If your Corporate Note has a step-up coupon schedule, the interest rate of your Corporate Note may be higher or lower than prevailing market rates. Generally, a step-up Corporate Note pays a below-market interest rate for an initial defined period (often one year).

Step up coupon bonds. PDF A guide to investing in brokered CDs - Wells Fargo Advisors The coupon may "step up" (increase) only once or as often as quarterly until the issuer calls the CD or the CD matures. Floating-rate CDs — Floating-rate CDs are CDs that pay interest based upon a predetermined spread over a reference rate or index. Floating-rate CDs present different investment considerations than fixed-rate or step-rate ... Step-Up Bond Definition - PFhub The definition of the financial term step-up bond. Find more finance definitions inside the PFhub glossary your Personal Finance Hub. PFhub - Business, Financial & Economic News ... Step-Up Bond Bonds in which the coupon rates 'step-up' during later period of the bond tenure. Random Finance Terms for the Letter S. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Unique Advantages of Zero-Coupon U.S. Treasury Bonds . Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time. Deferred Coupon Bonds | Definition, How it works? Types, Advantages Deferred Coupon bonds help businesses acquire finance without paying periodic interest. A lump-sum is paid including interest at the time of maturity. ... a company paying 4% interest on step-up bonds defers interest payments till maturity. On maturity, the company will pay interest at an increased rate (say) 5.5% for all the deferred periods. ...

PDF An Analysis of Step-Up Fixed Income Securities The step-ups may not be better than a fixed income bond. If what drew you to the step-up was those big yield numbers, think again. Considerations What are some of the considerations in purchasing these step-up ... Step-Up CD Date- Coupon Rate Actual Yield to Date Actual Yield to Date 01/20/2017 - 2.000% 2018 - 2% 2018 - 1% ... Solved 1. Which bonds are sold by investment-grade | Chegg.com Which bonds are sold by investment-grade issuers? a. Deferred coupon bonds b. TIPS c. PIK coupon bonds d. Step-up coupon bonds 2. Relative to an otherwise similar option-free bond, a: a. callable bond will trade at a lower yield. b. putable bond will trade at a lower price. c. callable bond will trade at a higher price. d. convertible bond will Step-Up Bonds Definition & Example | InvestingAnswers A step-up bond is a bond with a coupon that increases ('steps up'), usually at regular intervals, while the bond is outstanding. Step-up bonds are often issued by government agencies. How Do Step-Up Bonds Work? Let's consider a five-year step-up bond issued by Company XYZ. Step-Up Bond Explained - Moneyland.ch The term of a step-up bond is normally made up of a number of sub-terms. These are typically 1 year each. The interest rate used for coupons increases every ...

How to Issue Corporate Bonds (with Pictures) - wikiHow Jun 07, 2021 · Calculate the cost of issuing bonds. In order to issue corporate bonds, the company will have to be sure that it is able to make payments on the bonds. That is, future cash flows will have to be substantial enough to cover both the coupon payments every six months or every year and the par value of the bonds when they reach maturity. What is a Step-Up Bond? - Accounting Hub A step-up bond comes with a lower interest rate initially. Its interest rate steps up after a specific period as described by the issuer. The interest rate of this bond can increase over specified intervals and up to a specified extent. It can be a single increase in the interest rate and several hikes depending on the terms of the bond. Zero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ... Step-Up Bond Definition - Investopedia Because the coupon payment increases over the life of the bond, a step-up bond lets investors take advantage of the stability of bond interest payments while benefiting from increases in the coupon...

Step-Coupon Bond - Fincyclopedia In this sense, a step-coupon bond is similar in structure to a deferred-interest bond ( DIB) except that it is initially issued with a low coupon interest, which is later readjusted upward. A step-coupon bond may have an embedded call option which the issuer can exercise as the coupon level rises. This bond is also known as a reset bond. S 738

What are Step-up Bonds? Example, Types, Advantages, and ... - CFAJournal The coupon rate of the bond increases to 5% in its final year. It means the lender will receive $30 for each of the first two years, $45 for year two and year three, and finally receive $50 in the last year. The lender will also receive $1,000 on the maturity of the bond, as usual. Types of Step-Up Bonds

Step-Ups - Types of Fixed Income Bonds | Raymond James Introduction to Step-up Bonds: At the most basic level, step-up bonds have coupon payments that increase ("step-up") over the life of the bond according to a predetermined schedule. In most cases, step-ups become callable by the issuer on each anniversary date that the coupon resets or continuously after an initial non-call period.

Calling munis is too pricey | Bond Buyer The combined cashflows of the 3.50% callable bond and the 2.61% refunding bond will be the same as that of the step-up coupon bond. Clearly the issuer should prefer the 3% optionless bond to the 3 ...

Types of bonds based on cash flows - Fixed Income - AlphaBetaPrep A step-up coupon bond is a bond, either fixed or variable, whose spread increases incrementally over the life of the bond. Bonds with step-up coupons offer protection against rising market interest rates. It is because when market interest rates increase, the bond's coupon rates also increase thereby limiting any decrease in bond value.

Accounting for Step-Up Bond | Example | Advantage - Accountinguide Step Up Bond provide benefit to the holders while having some negative impact on the issuers. Step Up Bond Example Company ABC issues the step-up bond at $ 1,000 per bond. The initial coupon rate was 2%, and it will keep increasing 50% every year over the 5 years lifetime.

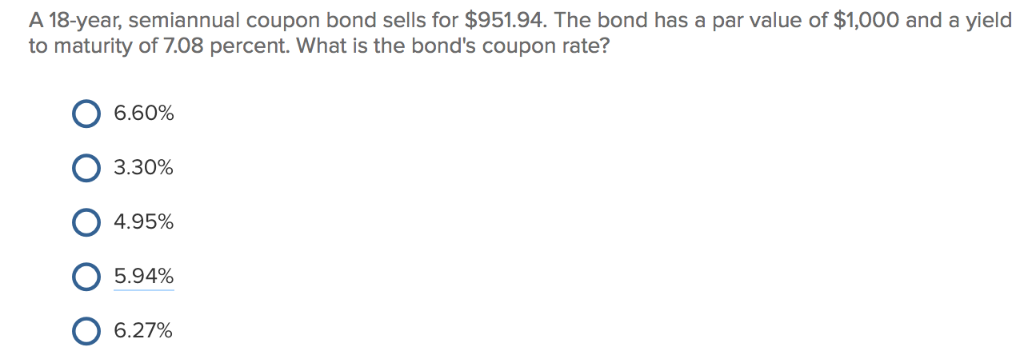

Coupon Rate Formula | Step by Step Calculation (with Examples) Formula to Calculate Coupon Rate. Coupon Rate Formula is used for the purpose of calculating the coupon rate of the bond and according to the formula coupon rate of the bond will be calculated by dividing the total amount of annual coupon payments with the par value of the bonds and multiplying the resultant with the 100.

All the 21 Types of Bonds | General Features and Valuation | eFM Jun 13, 2022 · Step-Up Bonds. The step-up bonds are where the coupon usually steps up after a certain period. They may also be designed to step up not once but in a series. Such bonds are usually issued by companies where revenues/ profits are expected to grow in a phased manner. These are also called dual coupon or multiple coupon bonds. Step Down Bonds. The ...

Step-Up & Step-Down Bond - Cbonds.com Step-Up and Step-Down bonds are fixed-rate bonds characterized by a trend, determined at the issue of the bond itself, which may be respectively increasing or decreasing over time. The typical predetermined coupon structure or variable over time represents this peculiar characteristic common to both types of bonds. Example of a bond.

Step up coupon bond which may be fixed or floating step-up coupon bond , which may be fixed or floating, increases by specified margins at specified dates.credit-linkedcoupon bond has a coupon that changes when the bond's credit rating changes.a payment-in-kind (pik) coupon bond typically allows the issuer to pay interest in the form of additional amounts of the bond issue rather than as a cash …

Step-Up Bonds - eFinanceManagement Step-up bonds or step-up notes are securities with a coupon rate that increases over time. These securities are called step-up bonds because the coupon rate "steps up" over time. For example, the step-up bond could have a 5% coupon rate for the first two years, 5.5% for the third and fourth years, and 6% for the fifth year.

Step-up bond financial definition of Step-up bond - TheFreeDictionary.com Step-up bond A bond that pays a lower coupon rate for an initial period, and then increases to a higher coupon rate. Related: Deferred-interest bond, payment-in-kind bond .

What Do I Need to Know About Step-Up Bonds? | Finance - Zacks One-step bonds have their coupon payment stepped up once during the life of the bond. For example, the coupon payment on a five-year bond may be 5 percent in the first and second years, then go to...

3 Ways to Buy Premium Bonds - wikiHow Aug 20, 2021 · Coupon: A coupon is an annual or semi-annual amount of interest paid on a bond to a bondholder. If a bond pays $50 annually, the coupon would be $50. The coupon may be expressed as a percentage of the face or par value, also known as the coupon rate. For example, you purchased a bond with a face value of $1000, and a coupon of $50.

What Is a Step-up Bond? - The Balance But suppose you had a step-up bond that offered 0.5% annual coupon increases. The step-up feature gives you some protection against rising interest rates. After year one, you could earn 3.5%. After year two, you'd receive 4%, and so on. However, there's no guarantee that step-ups will keep up with market rates. How Step-up Bonds Work

Step-Up Bond - Investing - ClearTax Aug 5, 2022 — A step-up bond is a security that has a coupon rate which increases with time. A step-up bond typically performs better than any other fixed- ...

Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Post a Comment for "40 step up coupon bonds"