40 zero coupon bonds tax

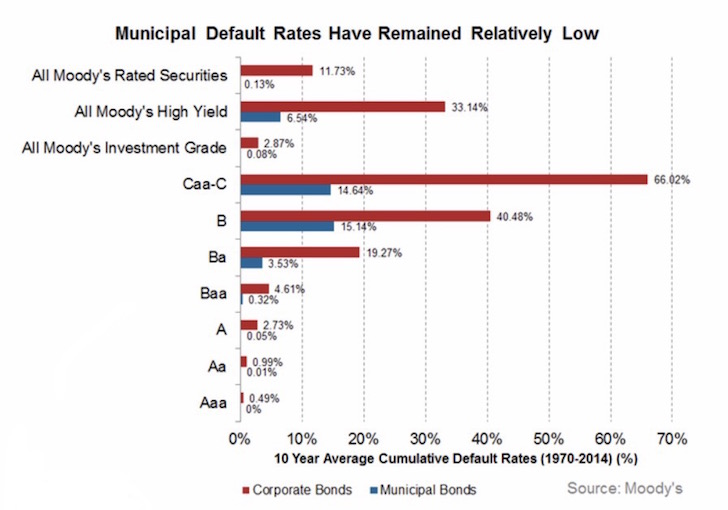

Tax Advantages of Series I Savings Bonds - The Balance This is due to the fact that they are a special type of bond known as a "zero-coupon," meaning that you won't receive regular checks in the mail; instead, the interest you earn is added back to the bond's value, and you'll earn interest on your interest. You have a choice between one of two taxation methods: the cash method or the accrual method. Market Watch 2021 | The Bond Market | Fidelity In 2020, 70% of the bonds in the broad taxable municipal index had credit ratings in the top 2 categories, up from 68% in 2019. That compares to only 9% of investment-grade corporate bonds in those categories, down from 11% in 2019. 5 Another distinction between taxable munis and corporate bonds lies in their potential tax implications.

Norway Government Bonds - Yields Curve The Norway 10Y Government Bond has a 3.149% yield. Central Bank Rate is 0.75% (last modification in March 2022). The Norway credit rating is AAA, according to Standard & Poor's agency. Current 5-Years Credit Default Swap quotation is 12.00 and implied probability of default is 0.20%.

Zero coupon bonds tax

Bondsindia Forum - Bonds & Fixed Income Queries A zero coupon bond is a debt instrument wherein the issuer does not make any coupon payment but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value. EGP T-Bonds EGP Treasury Coupon Bonds Auctions According to the Primary Dealers System. Tenor (Years) 5. Auction date. 13/06/2022. Issue date. 14/06/2022. Maturity Date. 05/04/2027. What is Phantom Income? (with picture) - Smart Capital Mind Zero coupon bonds are a common cause of phantom income. They yield no interest to those who possess them, but, because they are sold at a discount, are technically still profitable to their owners and thus taxable.

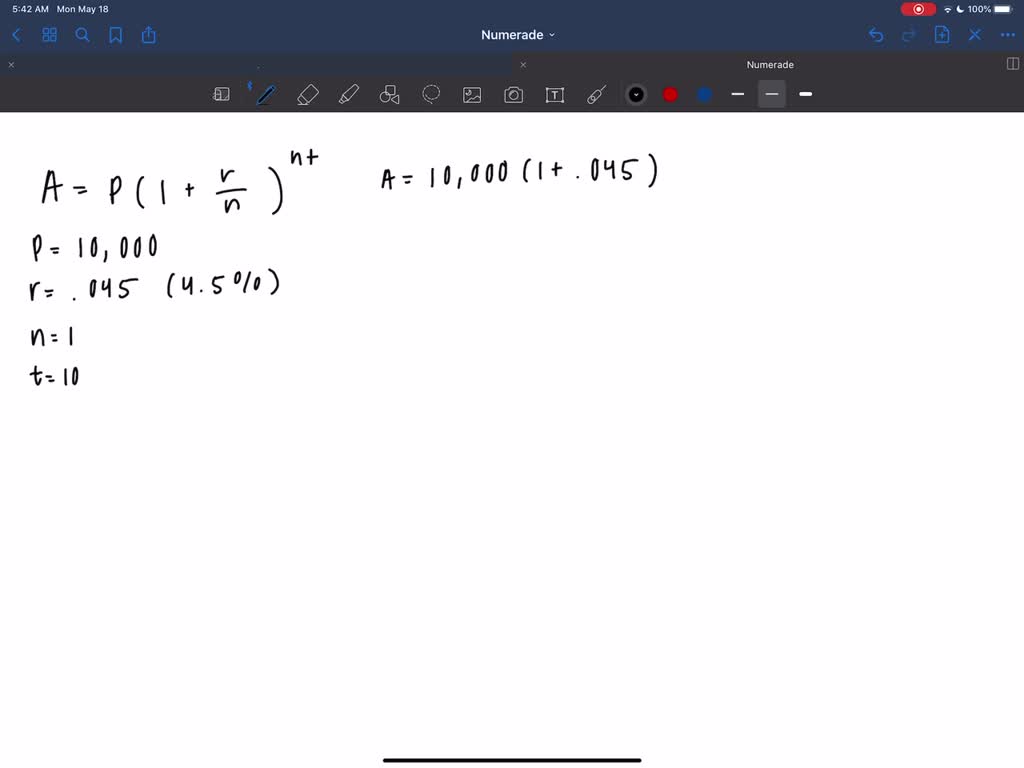

Zero coupon bonds tax. Learn How I Bonds Work - The Balance Paper bonds are sold in multiples of $50, $100, $200, $500, or $1,000. Electronic bonds can be purchased in any amount from $25 to $10,000, down to the penny. 1. Series I bonds earn interest starting on the first day of each month. That interest is compounded semi-annually based upon the issue date of the specific I bond. Zero Coupon 2025 Fund | American Century Investments Zero Coupon 2025 Fund - BTTRX SUMMARY PERFORMANCE COMPOSITION MANAGEMENT $106.43 | 0.13% ($0.14) NAV as of 06/08/2022 Historical NAV FUND FACTS Expenses and Dividends Recent Distribution History Historical Distributions Morningstar As of 05/31/2022 Morningstar Rating ™ How to Invest in Bonds: A Quick-Start Guide for Beginners In the U.S., bonds issued by the federal government are considered among the safest, such that the interest rate is very low. The government also issues "zero coupon bonds" that are sold at a... How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check.

Series I Bond Definition - Investopedia Series I Bonds and Interest Income Interest income for Series I bonds is taxable at the federal level, but not at the state and local levels. The series I bond is a zero-coupon bond, meaning that... Current Rates | Edward Jones Zero Coupon Bonds . Zero Coupon Bonds: Displays the rate range for Zero Coupon Bonds for terms from 0 to over 16 years. Term Rate Range; 0 - 5 Year: 2.56% to 3.62%: 6 - 15 Year: 3.8% to 5.16%: 16+ Year: 0% to 0%: These securities are derived from Government of Canada, Provincial Government, and Corporate bonds. The coupons are removed and sold ... Tax on Long Term Capital Gain under Income Tax Act, 1961 Generally, long-term capital gains are charged to tax @ 20% (plus surcharge and cess as applicable), but in certain special cases, the gain may be (at the option of the taxpayer) charged to tax @ 10% (plus surcharge and cess as applicable). Municipal Bonds Market Yields | FMSbonds.com Municipal Market Yields. The tables and charts below provide yield rates for AAA, AA, and A rated municipal bonds in 10, 20 and 30 year maturity ranges. These rates reflect the approximate yield to maturity that an investor can earn in today's tax-free municipal bond market as of 05/02/2022.

Brazil Government Bonds - Yields Curve The Brazil 10Y Government Bond has a 13.059% yield. 10 Years vs 2 Years bond spread is -102.2 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 12.75% (last modification in May 2022). The Brazil credit rating is BB-, according to Standard & Poor's agency. American Century Zero Coupon 2025 Fund Investor Class Returns Low AVG High Expenses LowAVGHigh Risk of this Category LOWERHIGHER More Performance 2 AS OF 5/31/2022 *AS OF 6/9/2022; Value is cumulative YTD (Daily)* -5.79% Average Annual Returns 1 Yr -3.24% 3 Yrs + 3.28% 5 Yrs + 3.01% 10 Yrs + 2.43% Summary Performance & Risk Ratings Composition Fees & Distributions View All Tabs Details More Term Premium on a 5 Year Zero Coupon Bond (THREEFYTP5) Graph and download economic data for Term Premium on a 5 Year Zero Coupon Bond (THREEFYTP5) from 1990-01-02 to 2022-06-10 about term premium, 5-year, bonds, and USA. SGS Bonds: Information for Individuals SGS bonds can be traded on the secondary market - at DBS, OCBC, or UOB branches; or on SGX through securities brokers. Maturity and redemption: No early redemption, but can be sold in the secondary market. Investors receive the face (par) value at maturity (i.e. price of S$100) Tax: There is no capital gains tax in Singapore.

ZERO COUPON GOVERNMENT BONDS - The Economic Times IOC raises Rs 1,500 cr via bonds at interest rate lower than sovereign The firm got bids worth Rs 5,403 crore in the range of 5 per cent to 6.7 per cent for its issuance. It priced the five-year rupee bonds at a coupon rate of 6.14 per cent tighter than a similar maturing government bond that is trading at an annualised yield of 6.29 per cent.

Treasury Bonds: A Good Investment for Retirement? Treasury bonds (T-bonds) are government debt securities that are issued by the U.S. Federal government and sold by the U.S. Treasury Department. T-bonds pay a fixed rate of interest to investors...

Learn about Massachusetts gross, adjusted gross, and taxable income ... Open file for TIR 80-2: Income Tax Treatment of Interest and Gains on Certain Bonds Open file for DD 88-19: Loss on Sale of Tax-Exempt Bonds Open file for LR 84-41: Zero Coupon Bonds Issues by Non-Massachusetts Municipalities; Original Issue Discount

Taxation of Debt Instruments by Bathiya.com For the sale of a security held in an unlisted company, the sale of debentures would be taxed at the rate of 10 percent without indexation or 20 percent with Indexation in the case of long-term capital gains (LTCG). Whereas, Short-term capital gains (STCG) arising from the sale of the same would be taxed at the rate of 30 percent.

1005 | U.S. Department of the Treasury Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. Corporate Bond Yield Curve. ... Host Discussion on Enhancing the Impact of Net-Zero Finance Commitments. June 6, 2022. ... prohibits U.S. financial institutions from participation in the secondary market for ruble or non-ruble denominated bonds issued after March 1, ...

What are Baby Bonds? | Learn More | Investment U Baby bonds are a product of either corporations or municipalities issuing debt to fund new initiatives. Many times, they come in the form of municipal bonds—called "muni bonds.". Like treasuries, they're tax-exempt. However, they're also often zero-coupon bonds, which negates their purpose as passive income investments.

Current Rates | Edward Jones 3.75%. $10,000,000 and over. 3.50%. Rates effective as of June 16, 2022 . The margin interest rate is variable and is established based on the higher of a base rate of 4.00% or the current prime rate. Our Personal Line of Credit is a margin loan and is available only on certain types of accounts.

Fitted Yield on a 3 Year Zero Coupon Bond (THREEFY3) Graph and download economic data for Fitted Yield on a 3 Year Zero Coupon Bond (THREEFY3) from 1990-01-02 to 2022-06-03 about 3-year, bonds, yield, interest rate, interest, rate, and USA.

Accounting for a non interest bearing note — AccountingTools This requires the following steps: Calculate the present value of the note, discounted based on the market rate of interest. Multiply the market rate of interest by the present value of the note to arrive at the amount of interest income.

What is Phantom Income? (with picture) - Smart Capital Mind Zero coupon bonds are a common cause of phantom income. They yield no interest to those who possess them, but, because they are sold at a discount, are technically still profitable to their owners and thus taxable.

EGP T-Bonds EGP Treasury Coupon Bonds Auctions According to the Primary Dealers System. Tenor (Years) 5. Auction date. 13/06/2022. Issue date. 14/06/2022. Maturity Date. 05/04/2027.

Bondsindia Forum - Bonds & Fixed Income Queries A zero coupon bond is a debt instrument wherein the issuer does not make any coupon payment but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value.

Post a Comment for "40 zero coupon bonds tax"