45 difference between coupon rate and market rate

Coupon Rate vs Yield Rate for Bonds | Wall Street Oasis The coupon rate of a bond represents the amount of actual interest that is paid out on a bond relative to the principal value of the bond (par value). Finding the coupon rate is as simple as dividing the coupon payment during each period divided by the par value of the bond. This is often referred to as the stated rate. Yield to Maturity vs Coupon Rate: What's the Difference The YTM considers market changes because, even though your bond's interest rate will not change, its value will fluctuate depending on the market's rates. You need to know the coupon rate, the price of the bond, its value, and the maturity date to calculate the YTM. If you purchase the bond at face value, the YTM and the coupon rate are the ...

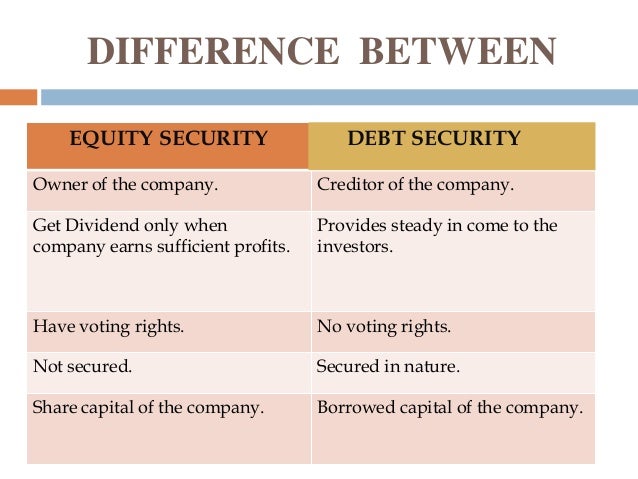

Bond Stated Interest Rate Vs. Market Rate | Pocketsense Because of the manner in which bonds are traded, the coupon rate often differs from the market interest rate. Tips A coupon rate is a fixed rate of return attached to the face value of the bond paid to the purchaser from the seller, while the market interest rate can change dramatically throughout the lifespan of the bond. Bond Basics

Difference between coupon rate and market rate

What is the difference between coupon rate and market A coupon rate is the yield paid by a fixed income security, a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bonds face or par value. The coupon created the yield the bond paid on its issue date. Coupon Rate vs Interest Rate | Top 6 Best Differences (With ... - EDUCBA The key difference between coupon rate vs interest rate is that interest rate is generally and in most of the cases are related to plain vanilla debt like term loans and other kinds of debt which are availed by companies and individuals for various business requirements. Difference Between Yield to Maturity and Coupon Rate The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. CONTENTS 1.

Difference between coupon rate and market rate. Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) The coupon rate is decided by the issuer of the bonds to the purchaser. The interest rate is decided by the lender. Coupon rates are largely affected by the interest rates decided by the government. If the interest rates are set to 6%, then no investor will accept the bonds offering coupon rate lower than this. Discount Rate vs Required Rate of Return - Financial Analyst Insider Acorn is offering a $5 Referral bonus for new signups.; Using the Required Rate of Return to Calculate Market Implied Discount Rate for a Stock. Now that we have an estimate for the required rate of return for US equities, we can use this to calculate the discount rate implied by the current stock price assuming we are calculating the discount rate for a dividend paying stock. Coupon vs Yield | Top 5 Differences (with Infographics) On the basis of the coupon payment and face value of the bond, the coupon rate is calculated. The yield of the bond, on the other hand, is the interest rate on the basis of the current market price of the bond and is thus also known as the effective rate of return for a bond. Difference Between YTM and Coupon rates Summary: 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author.

Difference Between Coupon Rate and Interest Rate (With Table) The main difference between Coupon Rate and Interest Rate is that the coupon rate has a fixed rate throughout the life of the bond. Meanwhile, the interest rate changes its rate according to the bond yields. The coupon rate is the annual rate of the bond that has to be paid to the holder. Yield to Maturity vs. Coupon Rate: What's the Difference? The coupon rate or yield is the amount that investors can expect to receive in income as they hold the bond. Coupon rates are fixed when the government or company issues the bond. The coupon rate... Solved What is the difference between a bond's coupon rate | Chegg.com We review their content and use your feedback to keep the quality high. 100% (2 ratings) A bond's coupon rate is the actual amount of interest income that the holder of a bond earns each year. The coupon rate …. View the full answer. What is difference between coupon rate and interest rate? The coupon rate is the rate the bond at 100% face of value the bond, usually $10,000. But as interest rates change in the marketplace, the real value and interest rate of the bond will change. Let's say a 20-year bond comes out at 3.0%. And then Fed raises its funds rate, 50 basis points or 0.5%. That would push up all interest rates.

Difference Between Coupon Rate and Discount Rate (With Table) The coupon rate is determined by the presumptive worth of the security, which is being contributed. The Discount rate is determined by thinking about the hazard of loaning the sum to the borrower. The guarantor of the securities chooses the coupon rate for the buyer. The moneylender chooses the Discount more rated. Difference Between Coupon Rate and Interest Rate What is the difference between Coupon Rate and Interest Rate? • Coupon Rate is the yield of a fixed income security. Interest rate is the rate charged for a borrowing. • Coupon Rate is calculated considering the face value of the investment. Interest rate is calculated considering the riskiness of the lending. Coupon vs Yield | Top 8 Useful Differences (with Infographics) While calculating the current yield, the coupon rate compares to the current market price of the bond. During the tenure of the bond, the bond price remains the same till maturity due to the continuous fluctuation of the market price; it is better to buy a bond at the discount rate which offers handsome returns on the maturity at face value. Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... A bond is priced at a discount below par value when the coupon rate is less than the market discount rate. All else equal, the price of a lower-coupon bond is more volatile than the price of a higher-coupon bond. ... Concept 91: Difference in Forward and Futures Prices; Concept 92: Exercise Value, Time Value, and Moneyness of an Option ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Bonds - Coupon and Market Rates Differ - YouTube Lesson discussing how the value of a bond changes when coupon rates and market rates differ. Looks at why a bond will trade at a premium, discount, or at pa...

State the difference between a bond coupon rate and market rate of ... Textbook solution for Financial Accounting 9th Edition Robert Libby Chapter 10 Problem 6Q. We have step-by-step solutions for your textbooks written by Bartleby experts!

What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

Solved The difference between the stated or coupon interest | Chegg.com Answer = C ( Changes monthly ) Stated or coupon rate of the bond is made by the bond issuer. Coupo …. View the full answer. Transcribed image text: The difference between the stated or coupon interest rate of a bond and the market interest rate for similar investments: A.

The Difference between a Coupon and Market Rate - BrainMass Coupon rate is the interest rate to be paid on the bond at regular interval. In this case coupon rate is 8%. If the face value of the bond is $1000, the holder of the bond will receive $80 at the end of every year during the duration of the bond. In addition the bond holder will receive $1000 back on the maturity of the ... Solution Summary

Finance exam 2 Flashcards | Quizlet It is also the expected return for an investor who buys the bond and holds it to maturity. The coupon rate determines the periodic interest payments made to investors. YTM is the expected return for an investor who buys the bond today and holds it to maturity. YTM is the prevailing market interest rate for bonds with similar features.

Important Differences Between Coupon and Yield to Maturity Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

Coupon Rate - Meaning, Calculation and Importance The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100. Coupon Rate = 100 / 500 * 100 = 20%.

Bond Yield Rate vs. Coupon Rate: What's the Difference? The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%. However,...

Difference Between Yield to Maturity and Coupon Rate The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. CONTENTS 1.

Coupon Rate vs Interest Rate | Top 6 Best Differences (With ... - EDUCBA The key difference between coupon rate vs interest rate is that interest rate is generally and in most of the cases are related to plain vanilla debt like term loans and other kinds of debt which are availed by companies and individuals for various business requirements.

What is the difference between coupon rate and market A coupon rate is the yield paid by a fixed income security, a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bonds face or par value. The coupon created the yield the bond paid on its issue date.

![Customer Lifetime Value: How 5 Brands Saw 2x Growth [Examples]](https://www.bigcommerce.com/blog/wp-content/uploads/2017/06/discount-rate.jpg)

Post a Comment for "45 difference between coupon rate and market rate"