44 a general co bond has an 8% coupon

8.docx - 1. You have a $1,000 par value bond with 5 years ... View 8.docx from FINANCE 3171 at Simon Fraser University. 1. You have a $1,000 par value bond with 5 years to maturity, a 9% coupon, and an 8% yield to maturity. Calculate the bond's price and General Dynamics, Biden's $770B Defense Bill, And Buffett ... In GD's case here, the current valuation is indeed about 12.5x FW EBT, almost exactly equivalent to purchasing a bond yielding 8%. At the same time, there is a good prospect of ~8% long-term growth.

Solved A General Co. bond has an 8% coupon and pays interest ... A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? Expert Answer 100% (10 ratings) Yield to Maturity is the internal rate of return of the Bond. It represents the amount of profit or loss on the …

A general co bond has an 8% coupon

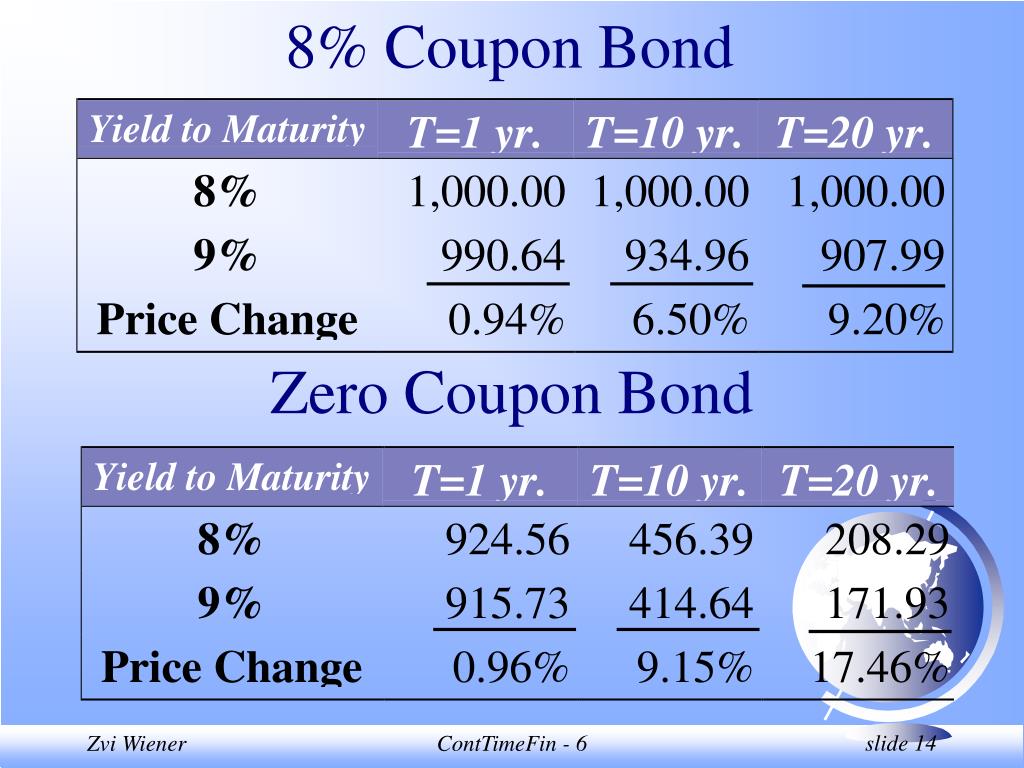

FIN 3000 HW 6 Flashcards | Quizlet Consider three bonds with 8% coupon rates, all making annual coupon payments and all selling at face value, which is $1000. The short-term bond has a maturity of 4 years, the intermediate-term bond has a maturity of 8 years, and the long-term bond has a maturity of 30 years. PDF Problem Set # 12 Solutions - University of New Mexico of the issuing company's stock is $19, and the conversion ratio is 40 shares. The bond's conversion premium is _____. A. $50 B. $190 C. $200 D. $240 Conversion premium = 950 - 40(19) = 190 2. A coupon bond that pays interest semiannually has a par value of $1,000, matures in 8 years, and has a yield to maturity of 6%. Finance Chapter 5 Flashcards | Quizlet A General Co. bond has an 8 % coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? 7.79%. Consider a bond which pays 7% semiannually and has 8 years to maturity. The market requires an interest rate of 8% on bonds of this risk.

A general co bond has an 8% coupon. A General Co. bond has an 8 % coupon and pays interest ... Jun 23, 2009 · The face value is $1,000 and the current market price A General Co. bond has an 8 % coupon and pays interest annually. A zero coupon bond has a face value of $ 1,000 and matures A zero coupon bond has a face value of $ 1,000 and matures in 6 years. Investors require a (n) 6.6 % annual return on these bonds. What should be the … read more Solved A General Co. bond has an 8% coupon and pays | Chegg.com A General Co. bond has an 8% coupon and pays interest semiannually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 7 years. What is the yield to maturity? A. 7.62% B. 7.79% C. 8.24% D. 8.12% Question: A General Co. bond has an 8% coupon and pays interest semiannually. FINANCE- A General Co. bond has an 8 percent coupon and pays ... 2 points Please Show the work QUESTION 2 1. A General Co. bond has an 8 percent coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures Vanilla Ice Co bonds pay an annual coupon rate of 10 and ... 3. Vanilla Ice Co. bonds pay an annual coupon rate of 10% and have 12 years to maturity. If investors' required rate of return is now 8% on these bonds… a) Will the bonds be selling at a premium or a discount with respect to their $1000 face value? Why?

CF Chp 8 Flashcards - Quizlet All else constant, a coupon bond that is selling at a premium, must have: A. a coupon rate that is equal to the yield to maturity. B. a market price that is less than par value. C. semi-annual interest payments. D. a yield to maturity that is less than the coupon rate. E. a coupon rate that is less than the yield to maturity [Solved] A company bond carries an 8% coupon, paid ... A company bond carries an 8% coupon, paid semiannually. The par value is $1,000, and the bond matures in 6 years. If the bond currently sells for Get more out of your subscription* Access to over 100 million course-specific study resources 24/7 help from Expert Tutors on 140+ subjects Full access to over 1 million Textbook Solutions Calculating the Present Value of a 9% Bond in an 8% Market The present value of the bond in our example is $36,500 + $67,600 = $104,100. The bond's total present value of $104,100 should approximate the bond's market value. It is reasonable that a bond promising to pay 9% interest will sell for more than its face value when the market is expecting to earn only 8% interest. BA 504 - Chapter 6 HW Flashcards | Quizlet a) Coupon payment = Coupon Rate x Face Value Current Yield = Coupon Rate/Bond Price. .08x 1000 = $80 80/.06 = $1,333.33 b) Less because the bond is selling at a premium. A General Power bond carries a coupon rate of 8%, has 9 years until maturity, and sells at a yield to maturity of 7%. (Assume annual interest payments.) a.

A General Co. bond has an 8% coupon and pays interest ... A General Co. bond has an 8% coupon and pays interest semiannually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 7 years. A general co bond has an 8 coupon and pays interest - Course Hero A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in20 years. What is the yield to maturity? A. 7.79 % B. 7.82% C. 8.00% D. 8.04% E. 8.12% B. 7.82 % Yield to maturity is the annual rate of return an investor receives if a bond is held to maturity. A 12 year 5 coupon bond pays interest annually The bond ... A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? A) 7.79% The bond sells at a premium, so its YTM has to be below 8%. A company issues a 10,000 par value 10-year bond with 8% ... The bond currently sells for $925. If the yield to maturity remains at its current rate, what will the price be 5 years from now math Consider an 8% coupon bond selling for $953.10 with three years until maturity making annual coupon payments. The interest rates in the next three years will be, with certainty, r1 = 8%, r2 = 10%, and r3 = 12%.

DOC Quantitative Problems Chapter 10 - University of Colorado ... A bond pays $80 per year in interest (8% coupon). The bond has 5 years before it matures at which time it will pay $1,000. Assuming a discount rate of 10%, what should be the price of the bond (Review Chapter 3)? 2. A zero coupon bond has a par value of $1,000 and matures in 20 years. Investors require a 10% annual return on these bonds.

Solved A General Co. bond has an 8% coupon and pays interest ... A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? 7.82% 8.12% 8.04% 7.79% 8.00% Question: A General Co. bond has an 8% coupon and pays interest annually.

A General Power bond with a face value of $1,000 carries a ... A three-year bond has 8.0% coupon rate and face value of $1000. If the yield to maturity on the bond is 10%, calculate the price of the bond assuming that the bond makes semi-annual coupon interest payments. Finance. The Carter Company's bond mature in 10 years have a par value of 1,000 and an annual coupon payment of $80.

GENERAL MOTORS CO.DL-NOTES 2017(17/27) Bond | Markets Insider The General Motors Co.-Bond has a maturity date of 10/1/2027 and offers a coupon of 4.2000%. The payment of the coupon will take place 2.0 times per biannual on the 01.04..

Bond Discounting Problems and Solutions - Accountancy ... Problem 10: ABC is Public Limited Company. The company board of director was decided to offer 1,000 no. of bonds of par value of $10 each in 2004; carrying 15 percent coupon rate and 5 year maturity period, bond would mature in 2009. The discount rate in first year (2005) was 10 percent. The rate was same in 2006.

Ch 6 HW Flashcards | Quizlet To sell a bond at its face value, the bond's coupon rate must be set equal to the yield to maturity of currently outstanding bonds. Thus, the new bond must offer a coupon rate of 7.18%. General Matter's outstanding bond issue has a coupon rate of 8.2%, and it sells at a yield to maturity of 7.25%.

PDF CHAPTER 33 VALUING BONDS - New York University interest between coupon payments and this accrued interest has to be added on to the price of the bond, when valuing the bond. Illustration 33.1: Valuing a straight bond at issue The following is a valuation of a thirty-year U.S. Government Bond at the time of issue. The coupon rate on the bond is 7.50%, and the market interest rate is 7.75%. The

A General Co. bond has an 8% coupon and pays interest ... A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity?...

Coupon Bond Formula | How to Calculate the Price of Coupon ... Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Determine the price of each C bond issued by ABC Ltd. Below is given data for the calculation of the coupon bond of ABC Ltd.

[Solved] Five years ago you purchased an 8% coupon bond for $975. Today you sold the bond for ...

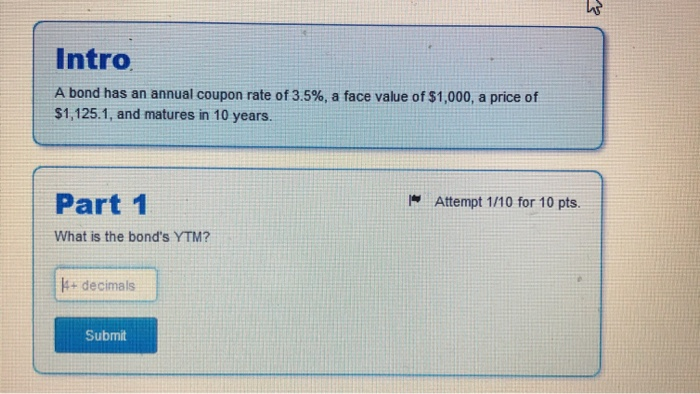

Yield to Maturity Questions and Answers | Study.com A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,018.50. The bond matures in 15 years. What is the yield to maturity? View...

Post a Comment for "44 a general co bond has an 8% coupon"