39 zero coupon bonds advantages

Buying Stocks Instead of Bonds: Pros and Cons - Investopedia Pros of Buying Stocks Instead of Bonds. The chief advantage stocks have over bonds, is their ability to generate higher returns. Consequently, investors who are willing to take on greater risks in ... U.S. Savings Bonds: Everything You Need to Know | The Motley Fool The bonds, known as "war bonds," were considered zero coupon bonds and paid no annual interest. ... Advantages of savings bonds. Can offer inflation protection; Encourage long-term investment;

iShares iBoxx $ High Yield Corp Bd ETF HYG - Morningstar IShares iBoxx $ High Yield Corporate Bond ETF HYG is an affordable option for exposure to U.S. high-yield corporate bonds. ... and zero-coupon bonds. Selected issues are weighted by their market ...

Zero coupon bonds advantages

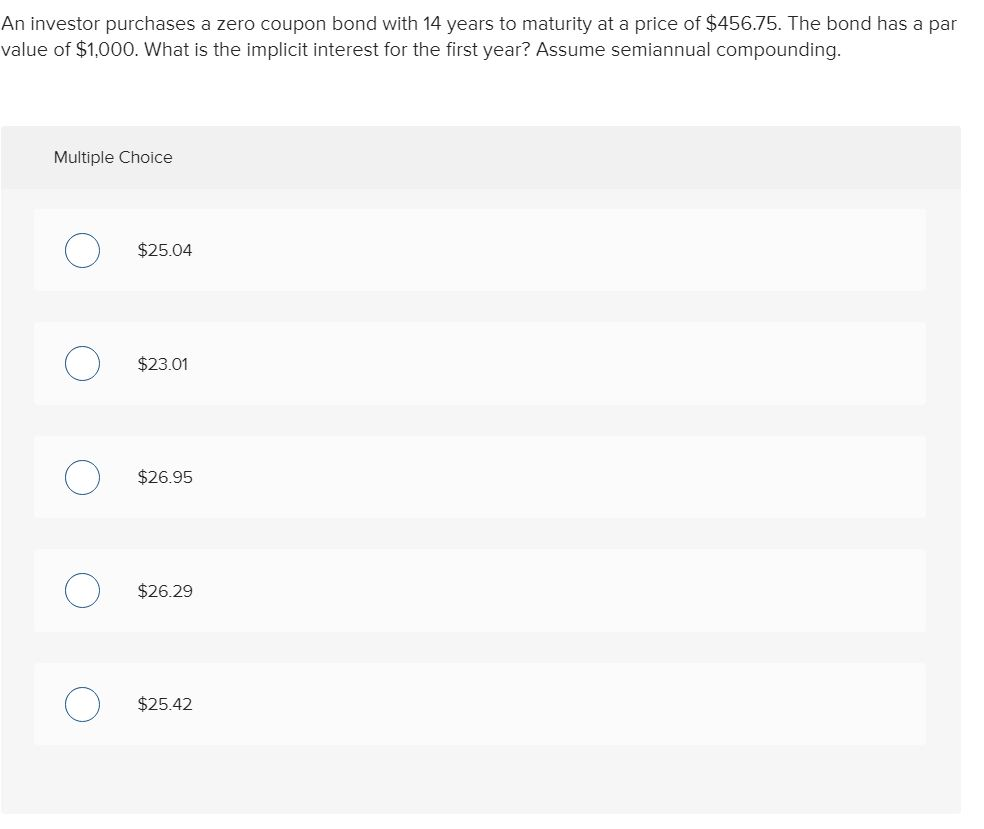

MMD: Strong Muni Performer To Lock In Higher Yields The fund's higher NAV NII yield profile of a 5.34% (vs. sector average of about 4.8%) is likely due to a combination of things such as its lower allocation to zero-coupon bonds, its slightly lower ... Finance - BrainMass Shares of Novotel will sell for either $150 or $80 three months later, with probabilities 0.60 and 0.40, respectively. A European call with an exercise price of $100 sells for $25 today, and an identical put sells for $8. Both options mature in three months. What is a price of a three-month zero-coupon bond with a face of $100? Question 1.1.Consider a zero-coupon bond with a $1,000 face value and ... Question 1.1.Consider a zero-coupon bond with a $1,000 face value and 10 years left until maturity. If the YTM of this bond is 10.4%, then the price of this bond is closest to _____. (Points : 10) $1,000 $602 $1040 $372Question 2.2.The Sisyphean Company has a bond outstanding with a face value of $1,000 that reaches maturity in 15 years.

Zero coupon bonds advantages. Bonds You Can Build On | PIMCO Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations ... How To Profit From Inflation: 3 Assets To Buy Now - WantFI.com By buying bonds to hold on their ledger, they force the price of bonds upwards above the face value, which lowers the yield commonly referred to as the "interest rate." Then when the Treasury issues new bonds, these new bonds are set to the Auction "market rate" at par which means they now have a coupon that pays a lower interest rate ... Buying I-Bonds Can Help You Beat Inflation I Bonds are inflation-protected savings bonds, issued and guaranteed by the United States Treasury. Because of the recent high inflation, I Bonds purchased before the end of October 2022 will yield 9.62 percent for the next six months. If inflation stays high, so will the yield. An I Bond has a 30-year maturity, which means it will pay ... Municipal Bonds | Tax-Advantaged Strategies | PIMCO One of the first municipal interval funds in the industry, the PIMCO Flexible Municipal Income Fund ("MuniFlex") aims to deliver higher after-tax yield than traditional municipal strategies. Overall Morningstar Rating™ among 42 funds. Based on risk-adjusted returns as of 03/31/2022.

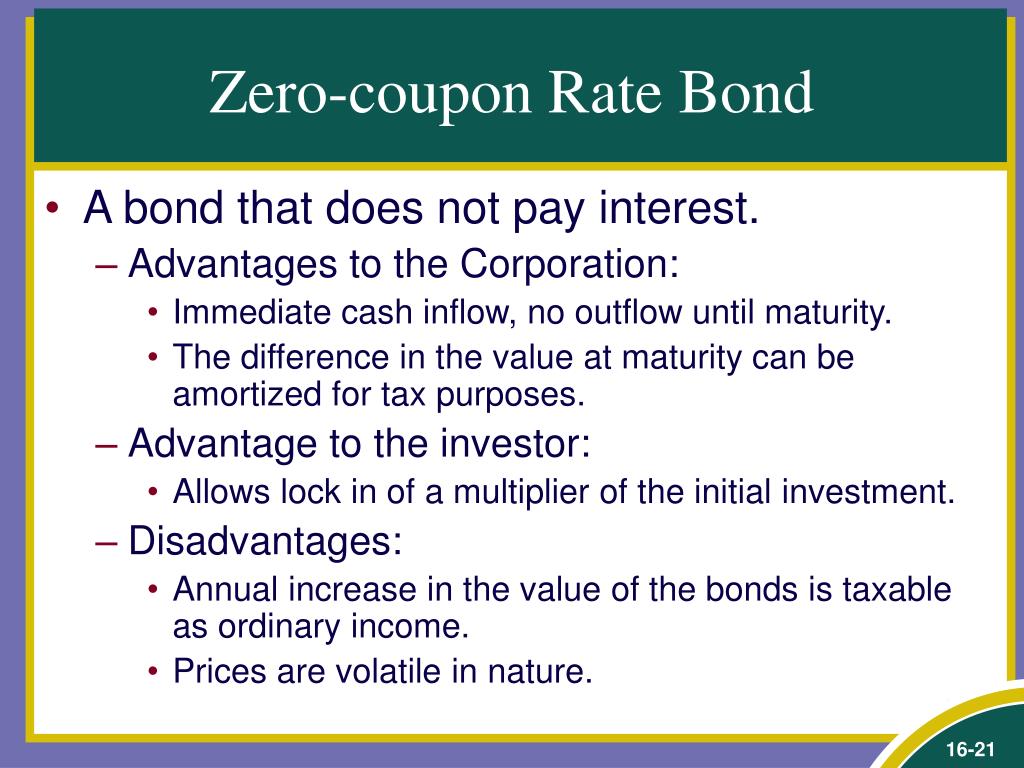

Norman Lehrer - Home - RBC Wealth Management Compounding Advantages of Zero Coupon Municipal Bonds. October 20, 2017 . RBC Wealth Management: Your Fixed Income Advantage Obtain more information about this financial advisor on FINRA's BrokerCheck website. Investment and insurance products offered through RBC Wealth Management are not insured by the FDIC or any other federal government ... 3% Treasuries Are A Bargain With 8% Inflation | Seeking Alpha Let's say you put $1,000 into a 30 year treasury when its yield is 3%. Then one year later, the yield on the 30 year falls to 2%. That means your treasury will be worth 29% more; $1,290 (29 ... All the 21 Types of Bonds | General Features and Valuation | eFM It is also known as a straight bond or a bullet bond. Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor. Articles - ICICI Direct Zero-coupon bonds work a little differently. In this article, find out what zero-coupon bonds are, their advantages and whether you should invest in them. 12 May 2022; ICICI Securities ; What are Cross Currency Pairs? The forex market is the largest financial market globally. Currency trading is a lucrative and booming business.

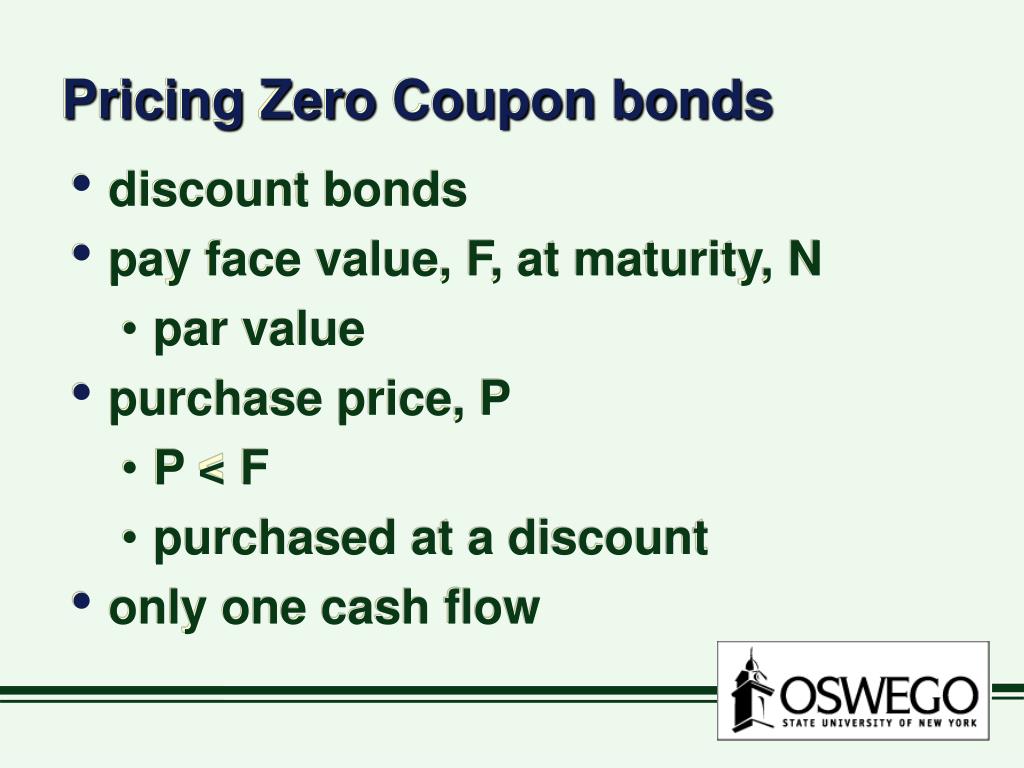

What Is a Zero-Coupon Bond? | The Motley Fool Understanding zero-coupon bonds. Zero-coupon bonds make money by being sold to investors at substantial discounts to face value. Zero-coupon bonds compensate for not paying any interest over the ... Zambia Government Bonds - Yields Curve The Zambia 10Y Government Bond has a 25.760% yield. Central Bank Rate is 9.00% (last modification in February 2022). The Zambia credit rating is SD, according to Standard & Poor's agency. Created with Highcharts 10.1.0. Residual Maturity Zambia Yield Curve - 16 May 2022 Zambia Government Bonds Zambia (16 May 2022) 1M ago 6M ago 10Y 24.75% 25% ... Early Retirement Now - You can't afford not to retire early! With tax advantages, too! ... 2022 March 21, 2022 by earlyretirementnow.com Posted in Asset Allocation, Safe Withdrawal Rates Tagged Asset Allocation, bonds, equities, finance, financial independence, ... essentially issuing a synthetic $20,000 zero-coupon bond maturing in December 2026 at a very competitive interest rate, significantly lower ... Yield to Worst - Meaning, Importance, Calculation and More Usually, bond issuers give both yields to maturity and YTW when they issue a callable bond. Advantages and Limitations of Yield to Worst. ... Calculating YTW is not relevant for zero-coupon bonds because these bonds do not give regular interest. Moreover, such bonds are normally issued and trades also at a high discount to its par value. ...

Pimco 25+ Year Zero Coupon U.s. Treasury Index Exchange-traded Fund ... ETF strategy - PIMCO 25+ YEAR ZERO COUPON U.S. TREASURY INDEX EXCHANGE-TRADED FUND - Current price data, news, charts and performance

COMPLETE guide to bearer bonds in the U.S. [2022] - Stilt Blog Bearer bonds come with coupons for every interest payment. Interest payments on bearer bonds are made at regular intervals by issuers. To claim interest, bondholders must submit a coupon to the issuer. Bearer bonds, therefore, are essentially used to lend and borrow money, much like a mortgage or a bank does.

Zero Coupon 2025 Fund | American Century Investments Each Zero-Coupon fund invests in different maturities of these debt securities and has different interest rate risks. The fund can only offer a relatively predictable return if held to maturity (2025). Investment in zero coupon securities is subject to greater price risk than interest-paying securities of similar maturity.

Convertibles seen as a buffer as rates go up "Investor demand for convertible bonds, just like demand in the credit market, became so hot (in 2021) that many companies were able to successfully issue zero-coupon convertible bonds," he said.

What Is a Treasury Note? How Does It Work? - TheStreet Treasury Notes are the U.S. government's intermediate-term bonds. Treasury notes are popular with investors because they provide a safe investment with a yield and lower risk than other bond ...

united states - Can zero-coupon bonds go down in price? - Personal Finance & Money Stack Exchange

American Century Zero Coupon 2025 Fund Investor Class Intermediate Government. Intermediate-government portfolios have at least 90% of their bond holdings in bonds backed by the U.S. government or by government-linked agencies. This backing minimizes the credit risk of these portfolios, as the U.S. government is unlikely to default on its debt.

I Bonds Rates Will Increase To 9.62% (May 2022 Update) Ninja Update 4/29/22: I Bonds purchased now will count as May purchases and immediately get the 9.62% rate. Purchases no longer gets the 7.12% + 9.62%. Instead you'll get the 9.62% rate for 6 months and then an unknown rate for the following 6 months. This is still a great opportunity to lock in a high return with zero risks.

Features and Advantages of Treasury Bills | Invest in T-Bills Features & Advantages of T-Bills. Features: Minimal investment required - According to the RBI regulations, the minimum investment in T-Bill should be ₹10,000. If to invest>₹10,000, the investment should be in the multiples of the minimum amount i.e. ₹10,000. Zero-coupon securities - T-bills provide no interest on the total investments ...

Key Features of Government Securities - NSE India Government bonds and State Development Loans pay interest every six months; Treasury bills are zero coupon bonds. They are issued by discount and redeemed at face value; Advantages of investing in G-sec, SDL and T-bill. Safety: Being Sovereign security, no default risk; Ease of Exit: Investor can sell the government bonds in the secondary market

New Zealand Government Bonds - Yields Curve The New Zealand 10Y Government Bond has a 3.810% yield. 10 Years vs 2 Years bond spread is 39.9 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.50% (last modification in April 2022). The New Zealand credit rating is AA+, according to Standard & Poor's agency. Current 5-Years Credit Default Swap quotation is 22 ...

10-Year Treasury Note Definition - Investopedia The 10-year Treasury note is a debt obligation issued by the United States government with a maturity of 10 years upon initial issuance. A 10-year Treasury note pays interest at a fixed rate once ...

Question 1.1.Consider a zero-coupon bond with a $1,000 face value and ... Question 1.1.Consider a zero-coupon bond with a $1,000 face value and 10 years left until maturity. If the YTM of this bond is 10.4%, then the price of this bond is closest to _____. (Points : 10) $1,000 $602 $1040 $372Question 2.2.The Sisyphean Company has a bond outstanding with a face value of $1,000 that reaches maturity in 15 years.

Cultivate an Understanding of Bonds Zero-coupon bond Also known as a discount or deep discount ...

Finance - BrainMass Shares of Novotel will sell for either $150 or $80 three months later, with probabilities 0.60 and 0.40, respectively. A European call with an exercise price of $100 sells for $25 today, and an identical put sells for $8. Both options mature in three months. What is a price of a three-month zero-coupon bond with a face of $100?

MMD: Strong Muni Performer To Lock In Higher Yields The fund's higher NAV NII yield profile of a 5.34% (vs. sector average of about 4.8%) is likely due to a combination of things such as its lower allocation to zero-coupon bonds, its slightly lower ...

:max_bytes(150000):strip_icc()/GettyImages-1139098478-28612b269b254a2488a4b4743dc4a9b9.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-932585920-5c910a5846e0fb000172f0e8.jpg)

Post a Comment for "39 zero coupon bonds advantages"